Advertisement|Remove ads.

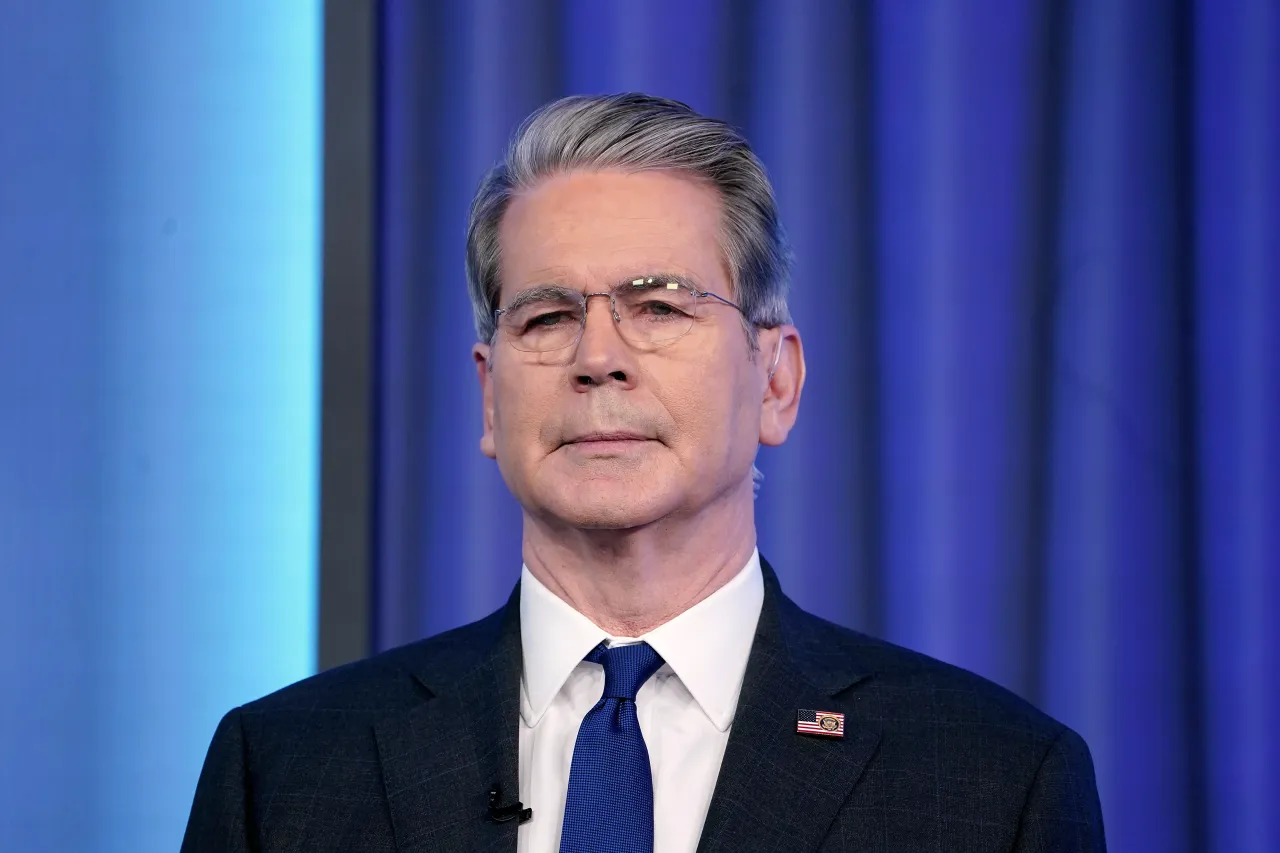

Bessent Disagrees With Musk’s ‘Optional Work’ Future – Says Jobs Will Evolve, Not Vanish

- “I think there's always going to be work. Historically, when you get productivity increases, more jobs always follow.” — Bessent.

- Musk stated that work might become optional and cited the example of some choosing to grow their own vegetables instead of buying them from the grocery store.

- Bessent added that confusing signals are emerging from the Federal Reserve regarding benchmark interest rates.

U.S. Treasury Secretary Scott Bessent disagreed with Tesla CEO Elon Musk’s assessment that work might become optional and said that the nature of jobs might change in the future amid the widespread adoption of AI and robots.

“I think there's always going to be work. Historically, when you get productivity increases, more jobs always follow,” Bessent said on Fox News show, The Ingraham Angle.

“If you think about the jobs of today, they won't be the jobs of tomorrow. That's what I constantly say. President Trump is always thinking about the jobs of tomorrow …. We don't have elevator operators anymore. But who would have thought that you'd be working in an Apple Store?”

What Did Musk Say?

Speaking at a panel discussion during the U.S.-Saudi economic summit, Musk said earlier this week that work might become optional. He added, “It’ll be like playing sports or a video game … you can go to the store and just buy some vegetables, or you can grow vegetables in your backyard. It’s much harder to grow vegetables in your backyard, but some people still do because they like growing vegetables.”

Musk, whose company expects to build a million humanoid Optimus robots within the next year, said that if there are continued improvements in AI and robotics, money would become “irrelevant” at some point in the future.

Bessent Says Confusing Signals Coming Out Of Fed

Despite many on Wall Street expecting the Federal Reserve to cut interest rates at its December meeting, the U.S. central bank’s policymakers have indicated that a rate cut might no longer be a certainty.

“I think there are a lot of signals coming from the Fed, and some of them are very confusing,” Bessent said. “They cut twice, and they said that they are insurance cuts. So I would have thought that they would want to take out a third cut.”

The Bureau of Labor Statistics data showed that the U.S. economy added 119,000 jobs in September before the government shutdown, well above expectations of 50,000. However, the unemployment rate also rose to 4.4%, the highest since 2021. According to CME Group’s FedWatch tool, over 63% of traders expect the Federal Reserve to maintain current rates until the next cycle.

Retail sentiment on Stocktwits about the SPDR S&P 500 ETF Trust (SPY) was in the ‘bearish’ territory, and traders were also bearish about Invesco QQQ Trust Series 1 (QQQ), which tracks the Nasdaq 100.

“I would believe that the Fed should be looking at the data and thinking, ‘we don't know where things are. We've been cutting, and we should finish the cutting cycle, or keep going with the cutting cycle,’ because again, the fourth quarter GDP will take a definite hit from the shutdown,” Bessent said.

Also See: New Fortress Energy Stock Rallies 20% After-Hours — Retail Smells Short Squeeze

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamie_dimon_jpmorgan_jpg_cbdd07fa63.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_So_Fi_new_6d7889a863.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_4_jpg_bb96bc484b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)