Advertisement|Remove ads.

Bharat Electronics May See Short-Term Pullback; SEBI RA Flags ₹397 As Re-Entry Point

Bharat Electronics (BEL) shares may be heading into a short-term correction.

According to SEBI-registered analyst Anupam Bajpai, the stock’s recent technical indicators show it is in an overbought zone, which could present an accumulation opportunity for medium- to long-term investors if a pullback occurs.

At the time of writing, shares of Bharat Electronics were trading at ₹408.35, up 0.6% on the day.

The analyst noted that BEL’s candlestick on Tuesday formed completely outside the upper Bollinger Band, and the Relative Strength Index (RSI) stood at 75, both of which suggested an overbought condition.

On Wednesday, BEL declined by nearly 2.7%, which Bajpai said validated the overbought signal and indicated the likely start of a correction phase.

Bajpai pointed to ₹397 as the 20-day moving average and described it as a likely near-term support level.

He said this could act as a possible re-entry point for investors during the expected price drift.

On fundamentals, Bajpai highlighted a current ratio of 1.76, a debt-to-equity ratio of 0.00, and promoter holding of 51.1%.

He said that the company is virtually debt-free, has a strong liquidity position, and enjoys high promoter confidence.

Last week, BEL said it secured orders worth ₹585 crore, including contracts for missile fire control and sighting systems, communication equipment, jammers, spares, and related services.

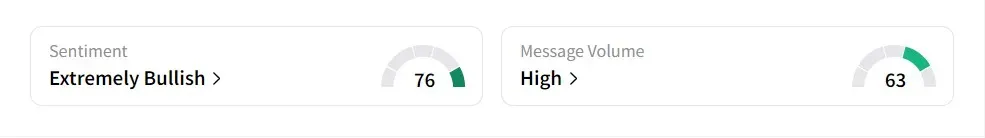

On Stocktwits, retail sentiment was ‘extremely bullish’ amid ‘high’ message volume.

The stock has risen 38.9% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)