Advertisement|Remove ads.

BioNTech's 2025 Revenue View, Vaccine Policy Uncertainty Prompt Price-Target Cut: Retail Stays Cautiously Optimistic

U.S.-listed shares of BioNTech SE ended Monday nearly 3.2% lower, weighed down by a weak full-year revenue projection even as the German drugmaker posted a quarterly earnings beat. Retail traders, however, did not appear too shaken.

Fourth-quarter revenue fell to 1.19 billion euros ($1.29 billion) from 1.48 billion euros a year earlier — as demand for COVID-19 vaccines shrank — but was better than Wall Street's estimate of 1.09 billion euros.

Likewise, Q4 earnings per share (EPS) fell to 1.08 euros from 1.88 euros a year earlier but easily topped a consensus estimate of 0.41 euros.

The company said clinical studies for late-stage oncology candidates raised research and development (R&D) expenses by nearly 6%.

For the current year, BioNTech projected revenue of 1.7 billion euros to 2.2 billion euros, below the market consensus of 2.54 billion euros and a fall from last year's 2.75 billion euros. The bulk of the sales are expected to come in the final quarter of 2025.

The outlook factors in stable vaccination trends, Pfizer-related inventory write-downs, revenue from Germany's pandemic preparedness deal, and BioNTech's service businesses.

The company anticipates full-year R&D costs rising to 2.6 billion euros to 2.8 billion euros from 2.25 billion euros in 2024, primarily due to late-stage development and commercial readiness in oncology.

Following the results, BofA Securities lowered its price target on BioNTech to $143 from $147 but kept a 'Buy' rating on the shares, noting that 2024 COVID-19 revenue was higher than consensus estimates.

However, the research firm flagged potential vaccination policy risks in the U.S. and other regions, saying it would monitor trends in 2025 while remaining optimistic about BioNTech's oncology pipeline, which includes over 20 late-stage trials. Multiple data readouts are expected this year and next.

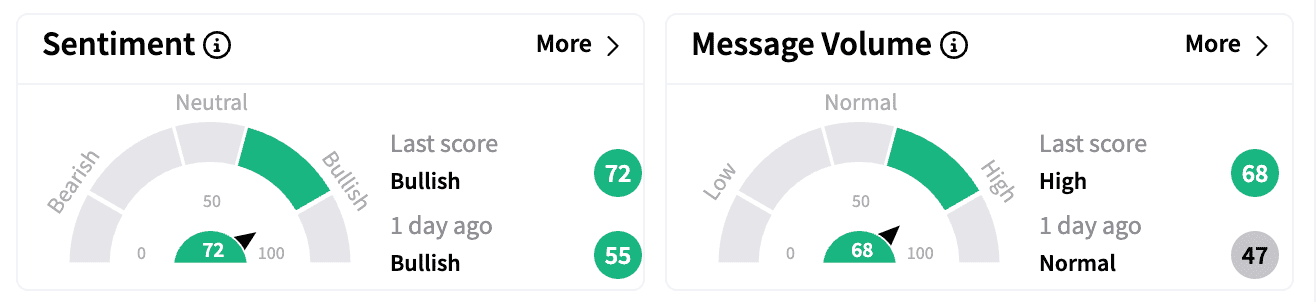

On Stocktwits, sentiment for BioNTech ended on a 'bullish' note on Monday amid a 600% spike in message volume, with shares climbing after the closing bell.

Amid some cautiousness over BioNTech's cash burn, optimistic watchers pinned hopes on the company's oncology pipeline and relatively cheap valuation.

BioNTech trades at a forward enterprise value-to-sales ratio multiple of 2.5, compared to Pfizer's 3.1 and Eli Lilly & Co's 13.1.

Shares are down over 8% this year but have gained 15.6% in the past 12 months.

BioNTech stock trades 38% below the average price target of $145.54 set by 21 Wall Street analysts. Of these, 12 rate it a 'Buy,' five a 'Strong Buy,' and four a 'Hold,' according to Koyfin data.

(1 euro=$1.08)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)