Advertisement|Remove ads.

Jobless Claims Unexpectedly Fall For Third Consecutive Week

- The four-week moving average for jobless claims, which smooths weekly volatility, rose by 1,750 to 218,750.

- Continuing claims fell to 1.87 million for the week ended December 20, declining by 47,000 over the previous week’s revised level

- The largest increase in claims was in New Jersey at 3,343, followed by Missouri at 1,608, whereas the largest decrease was in New York at 1,285 and Minnesota at 1,012.

Weekly jobless claims fell more than expected for the third consecutive week, according to data released by the U.S. Department of Labor.

Jobless claims fell by 16,000 to 199,000 in the week ended December 27. This was lower than a Dow Jones estimate of 220,000, as cited by MarketWatch. The previous week’s level was revised upward by 1,000 to 215,000.

The four-week moving average for jobless claims, which smooths weekly volatility, rose by 1,750 to 218,750.

This is the third consecutive weekly decline in jobless claims – benefit applications fell by 9,000 and 13,000 over the previous two weeks, according to Labor Department data.

Continuing Claims Fall

Continuing claims, which refer to the number of people claiming unemployment benefits beyond the first week, fell to 1.87 million for the week ended December 20, declining by 47,000 over the previous week’s revised level

The largest increase in claims was in New Jersey at 3,343, followed by Missouri at 1,608, whereas the largest decrease was in New York at 1,285 and Minnesota at 1,012.

The Labor Department data showed that jobless claims for the week of December 27 were the second-lowest in 2025, while those for the week of November 29 were the lowest this year. The decline in December 27 week’s claims was also among the most significant reductions this year.

At the end of 2024, jobless claims stood at 209,000, while 2025 ended with jobless claims of 199,000.

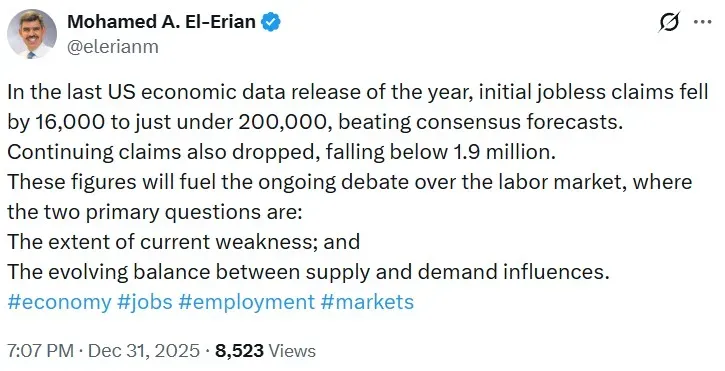

Economist’s Take

Mohamed El-Erian, Chief Economic Advisor at Allianz, said in a post on X that the jobless claims report will fuel an ongoing labor market debate, where the two primary questions are “The extent of current weakness; and The evolving balance between supply and demand influences,” the economist said.

Meanwhile, U.S. equities gained in Wednesday’s pre-market trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.1%, the Invesco QQQ Trust ETF (QQQ) gained 0.16%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) rose 0.02%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘neutral’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was down by 0.12% at the time of writing.

Also See: Why Is CORT Stock Falling Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamie_dimon_jpmorgan_jpg_cbdd07fa63.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_So_Fi_new_6d7889a863.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_4_jpg_bb96bc484b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)