Advertisement|Remove ads.

Bitwise Launches ETF Of Companies With Bitcoin In Their Coffers – Strategy Shares Surge As Stock Tops Holdings

Strategy’s stock rose over 6% in midday trading Monday after Bitwise launched a new exchange-traded fund (ETF) focused on companies with significant Bitcoin holdings.

The move came despite weakness in the broader market, with crypto-related stocks facing headwinds.

Bitwise’s new fund, the Bitwise Bitcoin Standard Corporations ETF (OWNB), is designed to track publicly traded firms holding at least 1,000 BTC in their treasuries.

Among them is Michael Saylor-led Strategy (formerly known as MicroStrategy), the largest corporate holder of Bitcoin, with 499,096 BTC – worth more than $41 billion at current prices – accounting for 20.87% of the ETF’s total assets.

The ETF allows investors to gain exposure to corporate Bitcoin reserves without directly purchasing the cryptocurrency.

Launched on March 11, the ETF includes over 70 companies that have integrated Bitcoin into their balance sheets.

Other notable names include Marathon Digital (MARA), CleanSpark (CLSK), Riot Platforms (RIOT), Bitfarms (BITF), BitFuFu (FUFU), Galaxy Digital (BRPHF), Hong Kong’s Boyaa Interactive, Japan’s Metaplanet, and Norwegian firm Aker ASA.

While Strategy’s stock saw gains, other Bitcoin-exposed companies struggled. Marathon Digital’s stock fell more than 3% as crypto stocks mirrored broader market weakness.

OWNB weights holdings based on the amount of Bitcoin a company owns, with a 20% cap on the largest positions.

Companies holding between 1,000 BTC and one-third of their total assets in Bitcoin receive a 1.5% weighting to maintain balance.

The ETF, listed on NYSE Arca, carries a 0.85% expense ratio and will rebalance quarterly.

According to Bitwise, publicly traded firms collectively held 591,817 BTC at the end of 2024.

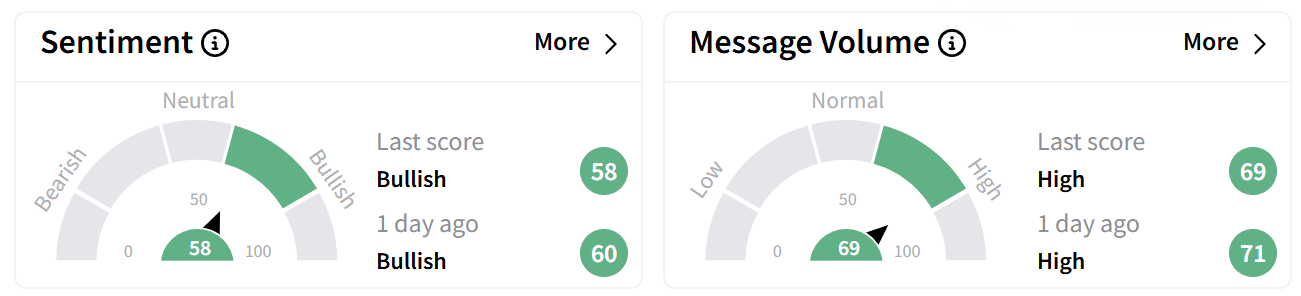

On Stocktwits, retail sentiment around Strategy’s stock remained in the ‘bullish territory’, accompanied by ‘high’ levels of chatter.

Many traders expected the stock to decline alongside the broader market.

Strategy’s stock has gained 59% over the past year but remains down 17% this year.

On Monday, the company announced its plans to raise up to $21 billion through an at-the-market (ATM) offering to buy more Bitcoin.

A new round of BTC purchases would push Strategy’s Bitcoin holdings past the 500,000 mark.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)