Advertisement|Remove ads.

Blackstone Stock Gets Price Target Cuts From Citi, Barclays, Piper Sandler — Retail Remains Bearish

Shares of private equity giant Blackstone Inc (BX) were in the spotlight on Tuesday morning after major Wall Street brokerages reduced their price targets for the stock.

According to TheFly, Citi analyst Christopher Allen lowered the firm's price target on Blackstone to $137 from $190 and kept a ‘Neutral' rating on the shares.

Citi lowered its estimates across the board in the broker and asset manager group to factor in a pushout of a capital markets recovery and lower performance fee expectations.

The brokerage also moderated fundraising expectations, noting that lower capital returns to limited partnerships could lead to incremental headwinds and delay fundraising cycles.

Piper Sandler also lowered its price target on the stock to $140 from $182 and kept a ‘Neutral’ rating on the shares.

The brokerage pointed out that asset managers have underperformed financials and the broader market year-to-date following outperformance last year.

According to TheFly, Piper Sandler said that following the Trump election, sentiment and outlook have shifted from what was initially believed to be an environment primed for alternative asset managers to one grappling with tariffs, a potential recession, and capital markets slamming shut.

On Monday, Barclays, too, lowered its price target on Blackstone to $129 from $186 and kept an ‘Equal Weight’ rating on the shares.

On the other hand, Citizens JMP upgraded the stock to ‘Outperform’ from ‘Market Perform’ with a $165 price target.

The brokerage noted that financial services stocks have declined materially, and the risk-reward ratio is becoming more favorable.

Blackstone has been in the news lately after its infrastructure strategy for individual investors division agreed to acquire a minority stake of 22% in AGS Airports from AviAlliance for £235 million (approximately $304.17 million).

Blackstone Infrastructure actively invests in the energy, transportation, digital infrastructure, and water and waste infrastructure sectors. It applies a long-term buy-and-hold strategy.

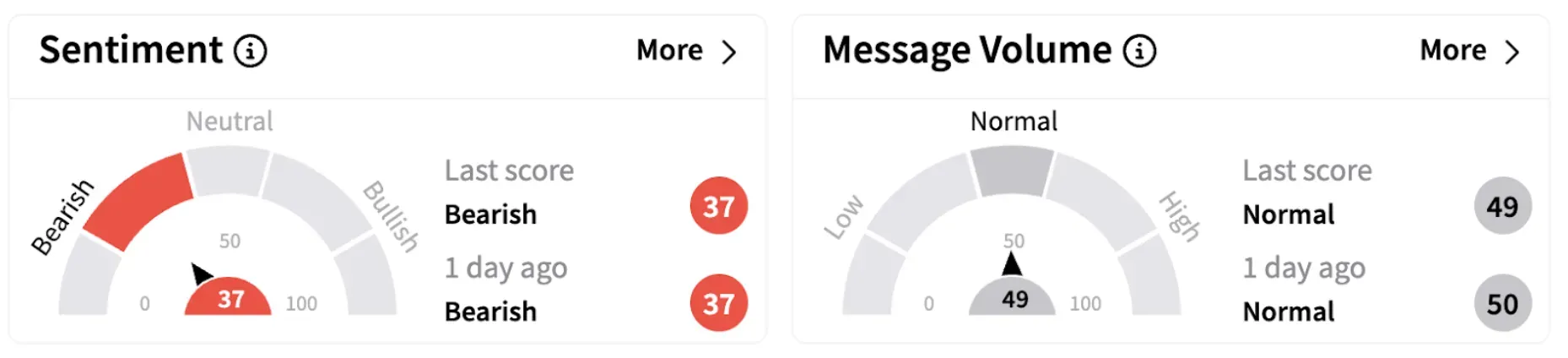

Meanwhile, on Stocktwits, retail sentiment continued to trend in the ‘bearish’ territory (37/100).

Blackstone shares traded 3% higher in Tuesday’s pre-market session. The stock has lost over 28% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)