Advertisement|Remove ads.

Bloom Energy Stock Rockets After Piper Sandler Upgrade: Retail Turns Exuberant

Shares of Bloom Energy Corp ($BE) rocketed nearly 50% on Friday after Piper Sandler reportedly upgraded the stock to ‘Overweight’ from ‘Neutral’ and raised the price target by $10 to $20.

The brokerage said the firm may be due for significant gains driven by its recent supply agreement with American Electric Power (AEP).

On Thursday, Bloom Energy announced that it has signed a supply agreement with AEP for up to 1 gigawatt (GW) of its products. The firm said that as part of the agreement, AEP has placed an order for 100 megawatts (MW) of fuel cells with further expansion orders expected in 2025.

Piper Sandler analyst Kashy Harrison believes the scale of the agreement could mean more growth opportunities for Bloom Energy in the future, despite the name carrying a softened sentiment among investors.

“Despite BE’s insistence that it was working on 100 MW deals and extremely bullish commentary from the [Chief Commercial Officer Aman Joshi] in a Taiwanese interview, the market has been generally skeptical on BE’s ability to deliver power to large data centers given prior grand unfulfilled promises,” he said, according to a CNBC report.

The analyst further noted that the 100 MW order from AEP is inline with previous commentary, but upside potential to 1-GW is 10x what the firm was expecting. “Given the endorsement of BE’s technology from a large utility, agreements with other large players could materialize,” the analyst said.

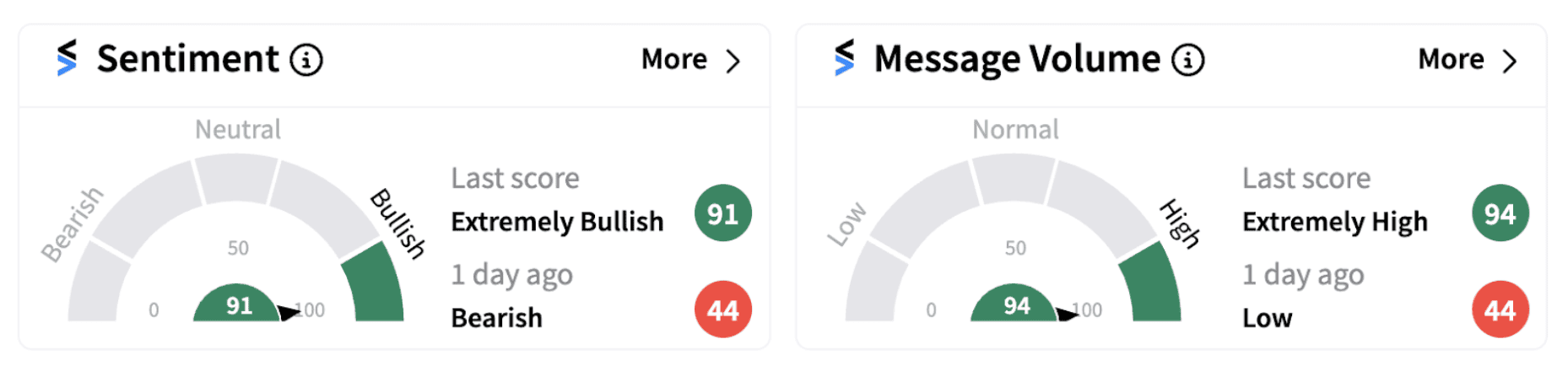

Following the developments, retail sentiment on Stocktwits jumped into the ‘extremely bullish’ territory (91/100) from ‘bearish’ a day ago.

One Stocktwits user believes the shares could hit the $30 mark by Monday.

Another user expressed optimism on the firm’s profitability in the coming times.

Shares of Bloom Energy have gained over 33% since the beginning of the year.

Also See: AST SpaceMobile Stock Tumbles As Losses Widen Sharply In Q3: But Retail Stays Defiant

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_39d73f48c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212776621_jpg_54c763cf43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)