Advertisement|Remove ads.

BMO Capital Has An Important Take On Gilead Sciences, Retail’s Keeping The Optimism Alive

BMO Capital opined on Monday that recent reports indicating Robert F. Kennedy Jr.'s plan to remove all members of the U.S. Preventive Services Task Force could be a potential headwind to Gilead Sciences (GILD).

The WSJ on Friday reported, citing people familiar with the matter, that the Health and Human Services Secretary plans to dismiss all 16 panel members of the advisory panel, which determines what preventive health measures insurers must cover, because he views them as too “woke”.

BMO deems this a headwind for Gilead, which recently got U.S. Food and Drug Administration approval for Lenacapavir, the company’s HIV prevention injection. Lenacapavir is a twice-yearly, long-acting injectable for use as pre-exposure prophylaxis (PrEP) by HIV-negative individuals to significantly reduce the risk of contracting HIV.

Pre-exposure prophylaxis (PrEP) is the use of antiviral drugs to prevent HIV infection in individuals who do not have HIV but are at risk of contracting it.

Besides Lenacapavir, Gilead also makes other HIV preventing medicines such as Truvada.

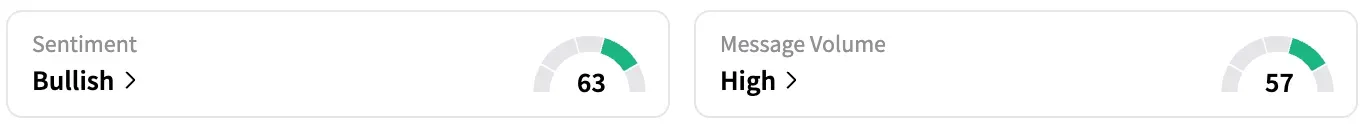

On Stocktwits, retail sentiment around Gilead trended in the ‘bullish’ territory, coupled with ‘high’ message volume. The stock is down by about 2% in Friday’s pre-market session.

The Supreme Court's Braidwood decision only concretized the power of the Department of Health and Human Services to decide what constitutes necessary preventive care, rather than outright protecting pre-exposure prophylaxis, BMO said.

The firm also noted that although there was no court decision on the status of pre-exposure prophylaxis as necessary preventative care, the zero copay protected status is a key component of its bullish view of the ongoing launch of Gilead's Lenacapavir.

BMO Capital keeps an ‘Outperform’ rating on Gilead. The company is expected to announce its second-quarter financial results after market close on August 7.

GILD stock is up by 23% this year and by about 46% over the past 12 months.

Read also: Royal Caribbean Q2 Preview: Retail Bears Hold Course, Stock Dips After Scaling Record Highs

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)