Advertisement|Remove ads.

Boeing Stock Draws Investor Attention After Citi Reiterates ‘Buy’ Rating, Anticipates 50% Upside: Retail Optimism Continues

Boeing Co (BA) shares drew investor attention on Friday after Citi reiterated a ‘Buy’ rating with a $210 price target.

According to TheFly, Citi noted that the market is undervaluing Boeing’s long-term growth potential at its current share levels.

Citi said the stock is pricing in less than 1% free cash flow growth in perpetuity. The brokerage also indicated a 3% growth rate is achievable, given the expected growth in the commercial aerospace and defense end markets.

This growth rate implies roughly 50% potential upside to Boeing's current share price, Citi noted.

On Wednesday, Boeing disclosed that its February deliveries surged 63% from last year to 44. The figure includes 31 of the company’s best-selling 737 MAX planes. The month also witnessed 13 orders and eight cancellations.

The latest figure brings Boeing’s 2025 total to 89, up from 54 in the same period a year ago.

According to Fitch ratings, the aircraft manufacturer has made early progress in resuming production after last year’s strike, reducing legacy inventory, and managing supply chains.

“While escalating trade and geopolitical tensions are a risk, Fitch views Boeing’s operational execution, profitability improvement, and balance sheet management as the main drivers for its rating over the next two years,” it said.

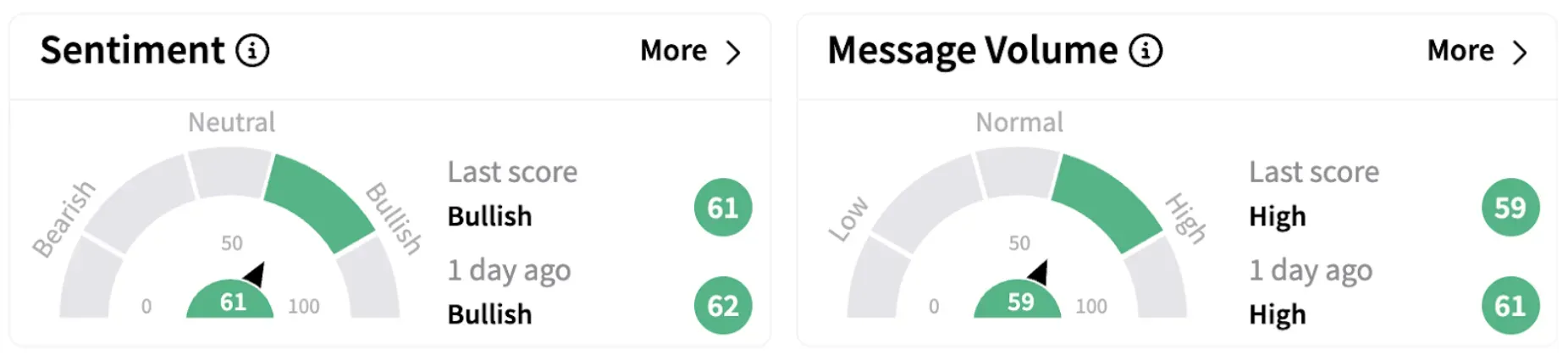

Meanwhile, on Stocktwits, retail sentiment continued to trend in the ‘bullish’ territory (61/100), accompanied by high message volume.

Boeing shares were trading marginally in the red during Thursday’s pre-market session. The stock has lost over 7% in 2025 and is down nearly 13% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_justin_sun_resized_jpg_80141eb4e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_hq_resized_af4cc05fd5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)