Advertisement|Remove ads.

Broadcom Gets A 15% Price Target Bump From Goldman Sachs Ahead Of Earnings

- Goldman Sachs’ price target implies a 15% upside from the chipmaker’s Tuesday closing price.

- The firm expects fiscal-year 2026 AI revenue guidance to exceed a 100% year-over-year increase.

- For the fourth quarter, analysts expect a revenue of $17.46 billion and earnings per share (EPS) of $1.87.

Goldman Sachs on Wednesday boosted its price target on Broadcom Inc. (AVGO) to $435 from $380, while reiterating a ‘Buy’ rating, ahead of fourth-quarter earnings scheduled to be reported on December 11.

The new price target represents a 15% upside to the chipmaker’s closing price on Tuesday.

AI Momentum

James Schneider, the Goldman analyst behind the move, pointed to accelerating AI demand, especially from major clients such as Google and OpenAI, as well as improving margins as Broadcom ramps up shipments of custom XPUs, according to TheFly.

The firm expects fiscal-year 2026 AI revenue guidance to exceed a 100% year-over-year increase.

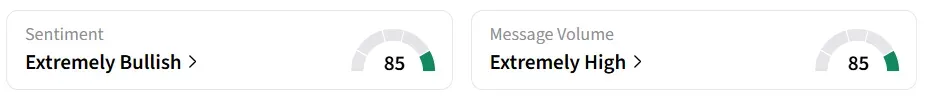

Broadcom’s stock inched 0.6% higher in Wednesday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

Demand For Specialized Accelerators

Broadcom’s custom-chip business is gaining steam as big tech firms pour resources into AI infrastructure. According to a CNBC report, Goldman Sachs anticipates hefty growth for Broadcom’s AI-related segment as demand for specialized accelerators and networking gear surges.

“We believe expectations are elevated heading into the quarter, and investors are positioned positively given strong peer results and positive datapoints related to key XPU customers, most notably Google following its latest Gemini 3 launch”, Schneider said.

According to Goldman, the mix between XPU-based hardware and networking products will influence profitability, especially as XPU volumes scale in fiscal 2026.

For Q4, analysts expect a revenue of $17.46 billion and earnings per share (EPS) of $1.87, according to Fiscal AI data.

AVGO stock has gained 66% in 2025 and over 133% in the last 12 months.

Also See: Who Will Trump Pick As Next Fed Chair? Here’s What Prediction Markets Show

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)