Advertisement|Remove ads.

Capricor’s Red-Hot Rally Has Wall Street And Retail Hooked — And Fresh DMD Data Could Keep Fueling The Fire

- H.C. Wainwright conservatively expects approval by the middle of 2026 and sees the shares trading well into the year-end.

- Capricor’s bumper rally on Wednesday helped the stock turn green for the year.

- Retail sees the stock as a long-term winner following the Phase 3 results.

Two decades after its modest beginnings and more than a decade after becoming a public company, San Diego, California-based Capricor Therapeutics made another stride toward becoming a commercial-stage company. After a failed first try, the small-cap biotech is hoping to push its experimental cell-therapy for a rare genetic muscular disorder past the finish line without any hiccups.

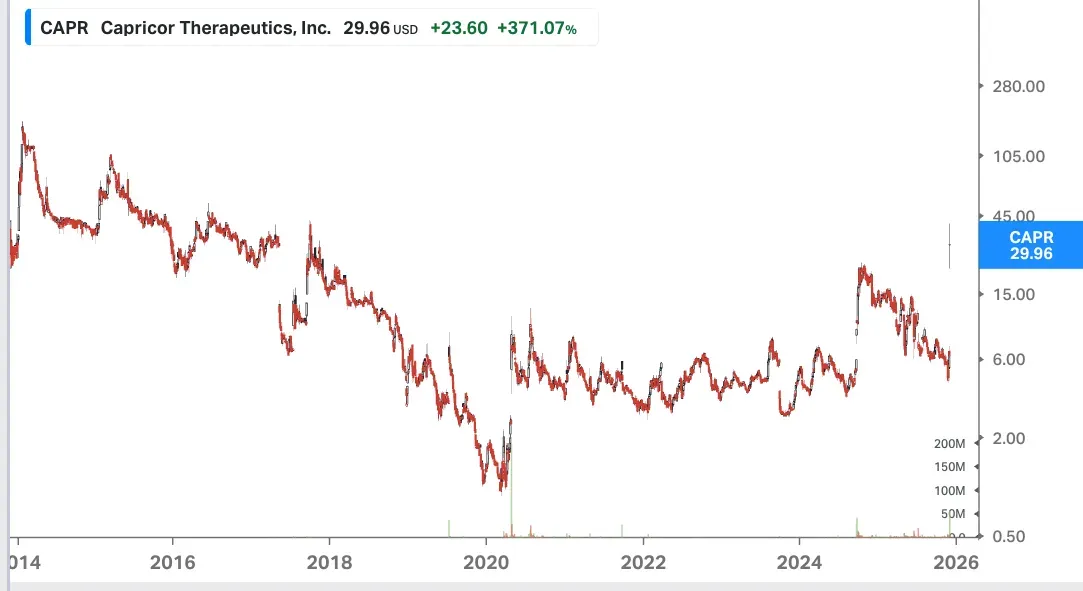

Wall Street analysts and the investment community received the recently released late-stage trial data for the treatment candidate well. While sell-side analysts were generous with their price target hikes, signaling their excitement toward the data, investors sent the stock up by over 530% at one point in Wednesday’s session. The initial euphoria faded slightly, but didn’t die out, as Capricor’s stock had enough verve to finish the day up 371% at $29.96, ending at an eight-year high and marking its best day ever.

Source: Koyfin

What Fueled CAPR’s Stratospheric Rally

Wednesday, before the market opened, Capricor reported positive topline results from the Phase 3 study, dubbed HOPE-3, evaluating its Duchenne Muscular Dystrophy (DMD) cell therapy candidate, Deramiocel.

-The primary endpoint, measured as the performance of upper limb (PUL), was met — showing statistically and clinically meaningful treatment effects in 54% of the patients.

-The key secondary endpoint of “Left Ventricular Ejection Fraction (LVEF),” a measure of heart health, was also met.

Thus, Deramiocel was shown to produce significant skeletal and cardiac benefits, supporting its credentials as a potential “first-in-class therapy” for Duchenne cardiomyopathy, the leading cause of mortality in DMD. The trial also gave the cell therapy a clean chit for its safety and tolerability.

Capricor said it would submit the detailed results from the HOPE-3 study at a future scientific meeting and for publication in a peer-reviewed journal.

Earlier in July, the FDA shot down Capricor’s initial application for Deramiocel, issuing a complete response letter (CRL) — a notice that an application cannot be approved in its current form. The agency expressed wariness about the company's efficacy data at the time and sought additional data. Industry experts saw it as a signal that the new leadership at the FDA could be veering toward a cautious approach.

CEO Linda Marbán said the study results, in addition to the evidence from the HOPE-2 and HOPE-2 OLE studies, would address the clinical issues in the CRL and support regulatory approval.

DMD is caused by a mutation in the DMD gene that prevents the body from producing the protein dystrophin. A lack of dystrophin hits muscle fibres, leading to muscle damage and loss.

What’s At Stake For Capricor

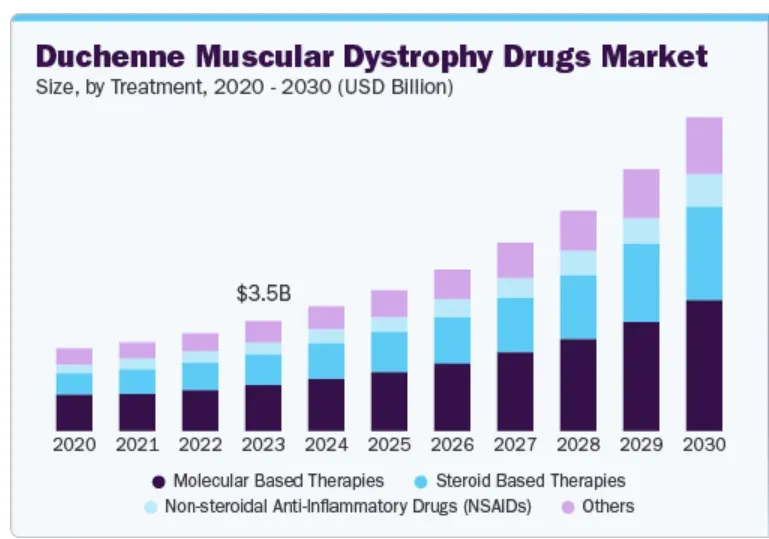

According to Grand View Research, the DMD drugs market is expected to grow at a compounded annual growth rate (CAGR) of 16.8% from 2024, reaching $9.91 billion in 2030. North America’s revenue share was at 45% in 2023. Global Data, meanwhile, has a more muted forecast, predicting a $5.2 billion market opportunity in 2033.

Source: Grandview Research

The DMD market is currently led by Sarepta, which has a gene-replacement therapy called Eteplirsen. Elevidys, a one-time single-dose gene transfer therapy, was approved in June 2023, and its label was expanded a year later to include patients ages four and older. The gene therapy generated $131.5 million in revenue for Sarepta in the third quarter.

Capricor’s Deramiocel differs from Elevidys in that it is a cell therapy that administers the patient's cardiosphere-derived cells, which secrete exosomes. The latter uses a manufactured gene for delivering the micro-dysrophin gene.

Sarepta also has three FDA-approved exon-skipping therapies, Exondys 51, Amondys 45 and Vyondys 53, and it is also currently working on RNA therapies.

Big Price Target Bumps

Following the data, H.C. Wainwright upped the price target for Capricor's stock to $60 from $24 and kept a 'Buy' rating, the Fly reported. The firm called the data a "decisive" win. With 78% of participants having underlying cardiomyopathy, the trial results addressed FDA concerns about sample size, the firm said. It conservatively expects approval by the middle of 2026 and sees the shares trading well into the year-end.

Alliance Global called the data "unequivocally and wholly positive" and removed the speculative tag from the stock. The firm hiked its price target for the stock to $48 from $16.

Retail Convinced Of Capricor Opportunity

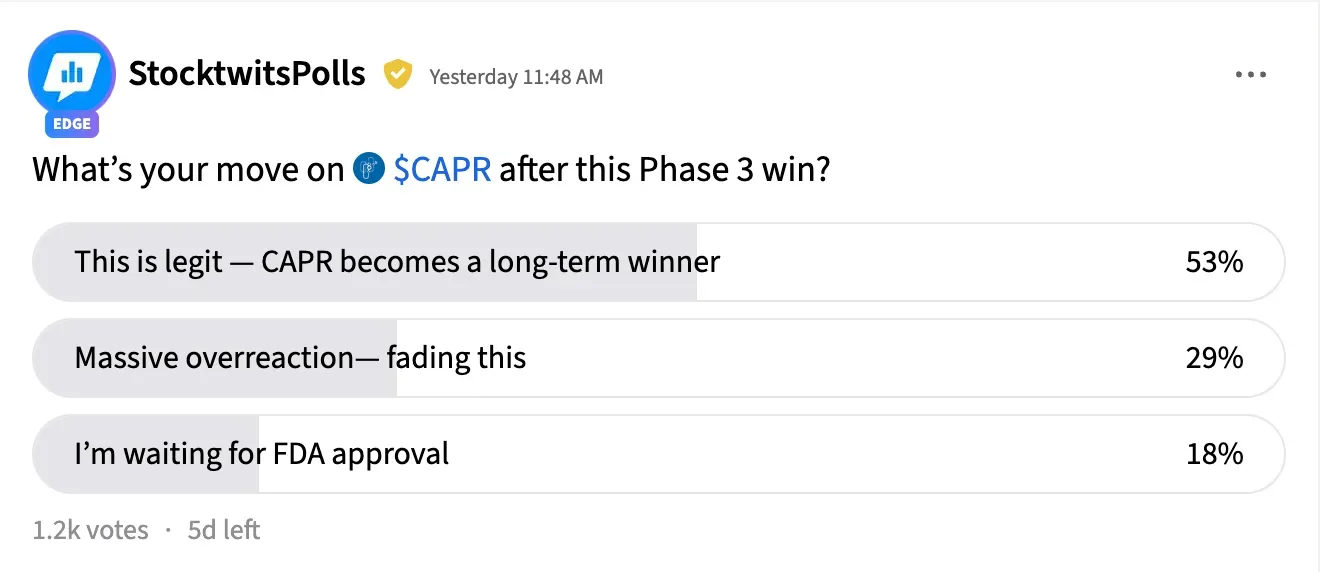

On Stocktwits, retail investors held an 'extremely bullish' stance on Capricor stock as of early Thursday. The message volume on the stream was 'extremely high as well.

A majority of retail traders are sold on Capricor's long-term potential. An ongoing Stocktwits poll asking users "What's your move on $CAPR after this Phase 3 win?" found that 53% of respondents said "This is legit — CAPR becomes a long-term winner," while 18% remained on the sidelines, waiting for approval to come through. About 29% shrugged off the rally as an "overreaction."

CAPR stock has soared about 117% this year, as Wednesday's bumper rally helped it recoup all its losses to that point and turn green for the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Whispers Of An Apple Deal Rebooted Intel’s Year — Now The Market’s Asking Whether The Old Chip Giant Can Rise Again

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)