Advertisement|Remove ads.

CoreWeave Vs. Nebius: AI Infra’s Breakout Duo Backed By Nvidia Is Outrunning Big Tech — But Which One’s The Better Bet?

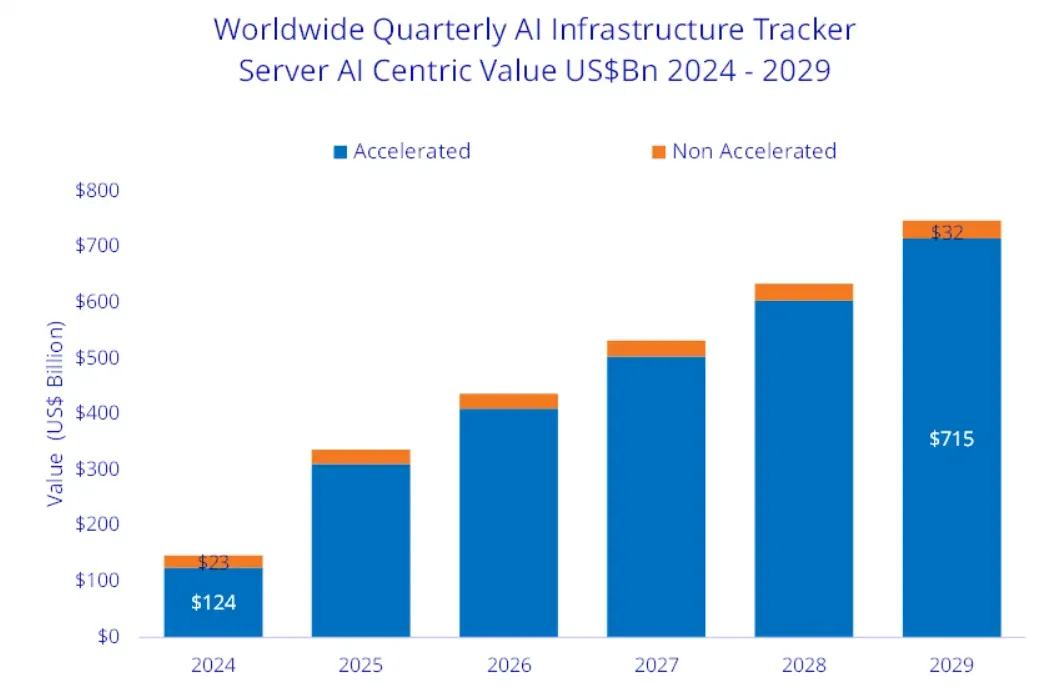

- According to IDC, the global AI infrastructure market is expected to witness $758 billion in spending by 2029, rising from $82 billion in Q2’25.

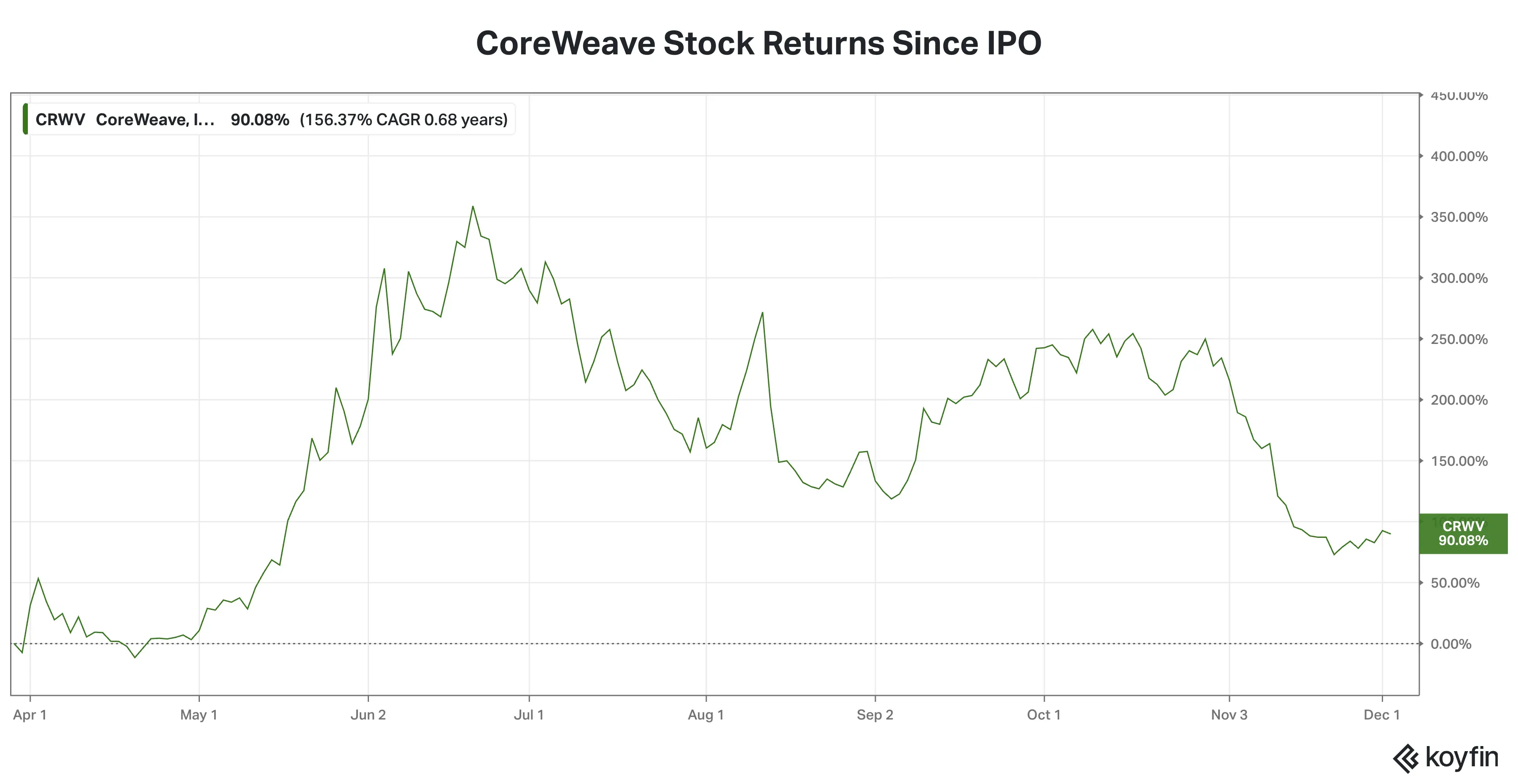

- CoreWeave stock is up 90% since its IPO, though it is trading 60% off its June highs.

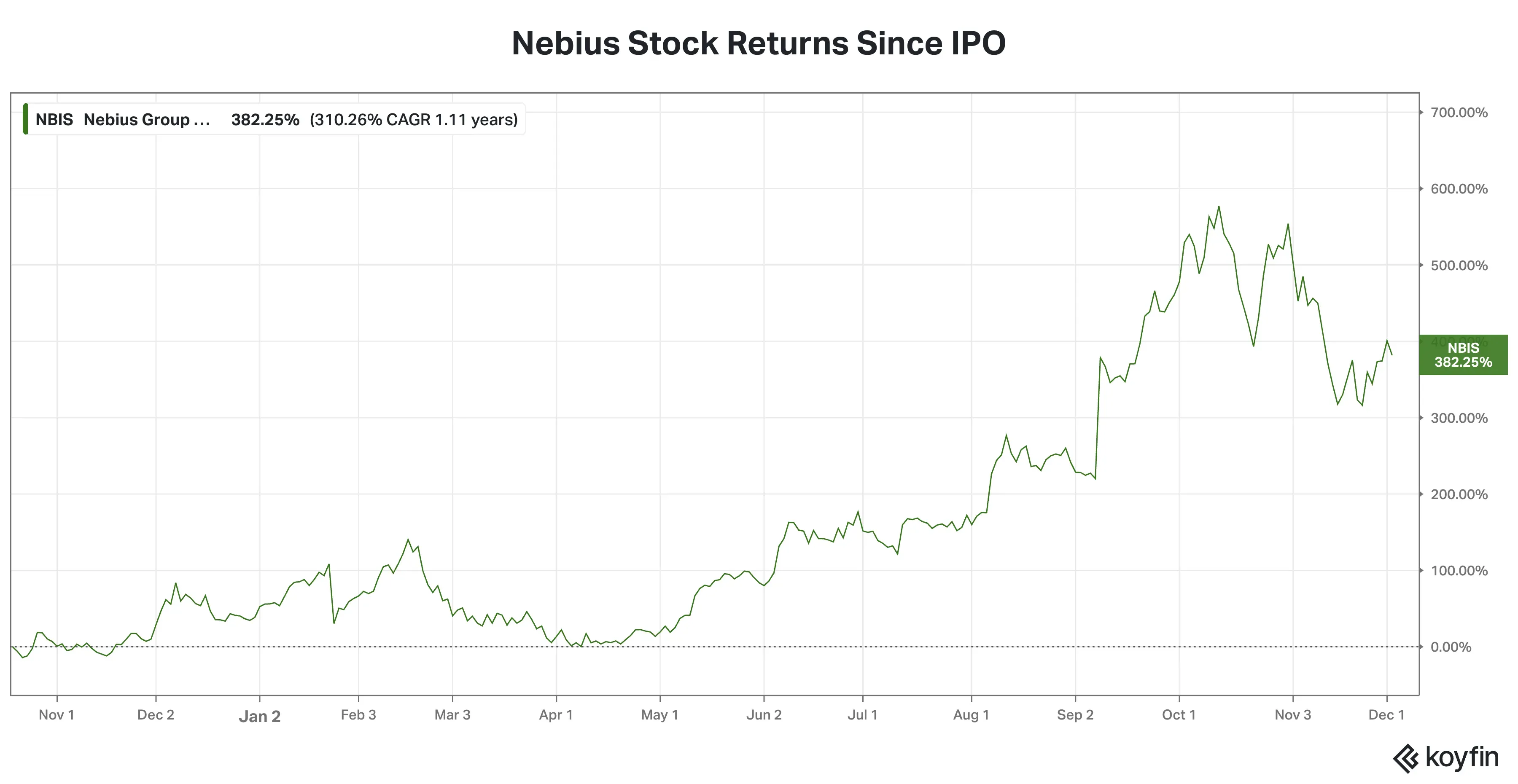

- Since Nebius’ Oct’24 debut, the stock has gained nearly 400%.

Investors who bought into two recent artificial intelligence (AI) infrastructure initial public offerings (IPOs) would have been rewarded handsomely. AI infra plays CoreWeave and Nebius have outperformed the broader market, the tech industry, and even the high-profile megacaps this year as demand for computing power skyrocketed.

So, how do these AI infra companies fit into the grander scheme of the AI revolution?

Both CoreWeave and Nebius belong to a class of companies that provide large-scale facilities that house and manage specialized hardware and software for AI workloads, such as machine learning, large-language model training, and inferencing.

Booming Market

Notwithstanding all the AI doomsday talk, CoreWeave and Nebius are operating in a market experiencing exponential growth.

According to IDC, the global infrastructure market is expected to witness $758 billion in spending by 2029, rising from $82 billion in the second quarter of 2025. Much of the second-quarter growth has been driven by investment in servers for AI deployments, and the U.S. accounted for 76% of the spending.

Source: IDC

The future appears very encouraging. Lidice Fernandez, IDC, group vice president, Worldwide Enterprise Infrastructure Trackers, said, “There is a distinct possibility that more AI-related investment will be announced in the coming years that will add to and extend the current mass deployment phase of accelerated servers well into 2026 and even beyond.”

CoreWeave, Nebius - Nvidia Portfolio Companies

AI stalwart Nvidia has invested in both companies, with the chipmaker’s latest 13F report showing a 24.28 million-share stake in CoreWeave and a 1.19 million-share stake in Nebius. This translates to a little under 5% stake in Coreweave and about 0.5% stake in Nebius.

The Rip-Roaring Debuts

CoreWeave preceded Nebius in making a public debut, offering 37.5 million shares at $40 apiece, to raise $1.5 billion. Shares of the Livingston, New Jersey-based company were listed on March 28. After ending the debut session unchanged, the stock was held down by the Trump tariff sell-off in early April but came back sharply, peaking at $187 in late June.

The buying moderated subsequently, as investors turned skeptical about a $9 billion deal the company announced to buy peer Core Scientific. With the latter’s shareholders spurning the proposed combination, the deal fell through. The relief rally in CoreWeave stock subsequently stalled amid the tech-led sell-off that began in late October.

Source: Koyfin

Source: Koyfin

CoreWeave stock is up 90% since its IPO, though it is trading 60% off its June highs.

Nebius, a Dutch AI infra company, was a spin-off from the publicly traded Yandex Group, the Dutch holding company of Russian Internet giant Yandex. After the Russia-Ukraine war, the Nasdaq suspended trading in the parent company’s shares in March 2022. The stock was delisted from the exchange a year later. Yandex appealed the delisting decision and agreed to divest all Russian assets in 16 months.

This divestment concluded in July 2024, and the leftover business included infrastructure and business units outside Russia. The shares of the spin-off business, named Nebius, began trading on the Nasdaq on Oct. 21, 2024.

Since its debut, the stock has gained nearly 400%.

Source: Koyfin

Nebius stock received a major boost in early September when the company announced a multi-billion-dollar deal with Microsoft to deliver dedicated capacity to the software giant from its new Vineland, New Jersey data center. Reacting to the news, the stock jumped 49% in a single session.

CRWV vs. NBIS: How Revenue, Profit Stack Up

Nebius reported a 355% year-over-year (YoY) increase in revenue for the third quarter ended Sept. 30 to $146.1 million and reported an adjusted loss of $100.4 million. On the other hand, CoreWeave’s topline grew 128% YoY to $1.37 billion, and its adjusted loss was $40.97 million.

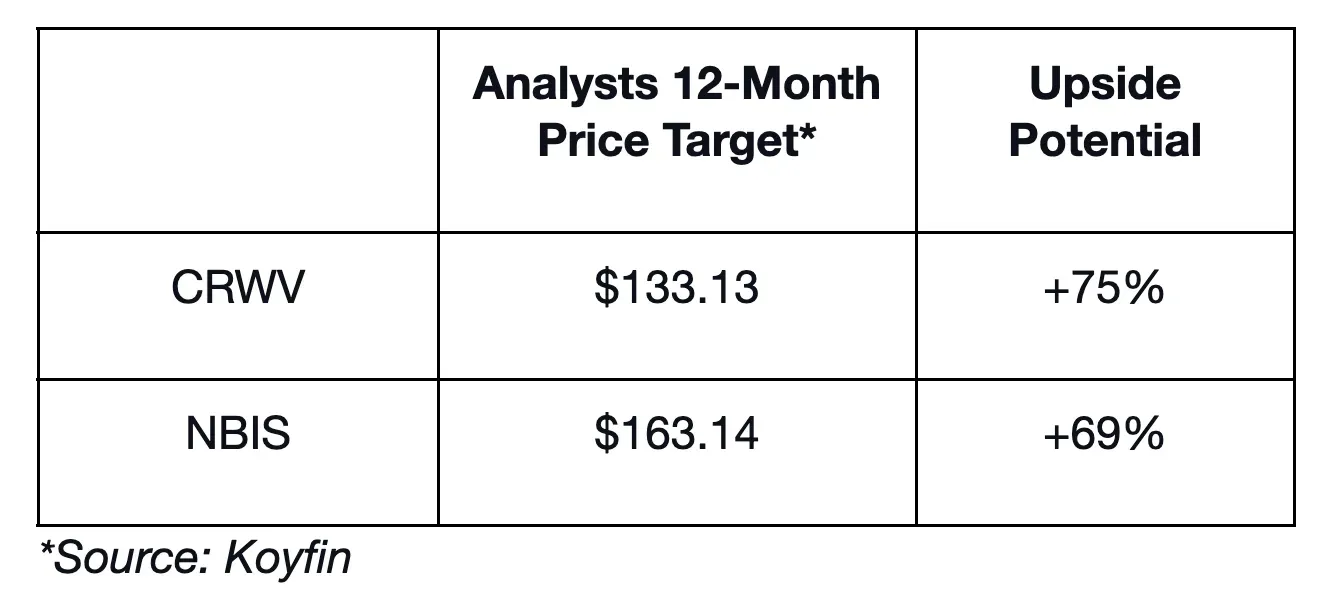

CRWV vs NBIS: How Sell, Retail Are Positioned

According to Koyfin, 14 of 27 analysts are bullish on CoreWeave stock (52%), while 7 of 8 are bullish on Nebius (88%). The former has a sell recommendation from two analysts, while Nebius doesn’t have a sell rating from any analyst covering the stock.

However, Stocktwits retail users have turned ‘bearish’ on both Nebius and CoreWeave amid the recent rise in AI skepticism.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Are Hollywood's Box-Office Blues Finally Over? Major Theater Stocks Give Us The Full Picture

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)