Advertisement|Remove ads.

Carmax's Strong Q1 Report Underscores Tariff Tailwinds For Used Cars Sector: Retail Investors Optimistic

Carmax (KMX) topped estimates for first-quarter results on Friday, and, with strong results from peer Carvana (CVNA) last month, strengthened the view that the U.S tariffs are helping drive used car sales.

President Donald Trump announced sweeping tariffs in April, which included special duties on foreign cars and certain car parts. Anecdotal data showed consumers turned to used cars in anticipation of the tariffs before April, as well as after they were revealed.

"We delivered our fourth consecutive quarter of positive retail comps and double-digit year-over-year earnings per share growth," CEO Bill Nash said in a statement. During the earnings call, he acknowledged the benefits of tailwinds from market dynamics, while also praising the company's inventory management, pricing, and cost savings.

Carmax's first-quarter revenue rose to $7.55 billion from $7.11 billion, beating the analyst estimate of $7.51 billion. Comparable store sales rose 8.1%, above the estimated 6.1%.

Used-vehicle sales were 230,210, a 9% increase on the prior year's quarter and the fastest quarterly growth since the quarter ended November 2021. However, the average selling price for used vehicles fell 1.5%.

Net income rose to $1.38 a share, beating the analysts' estimate of $1.16.

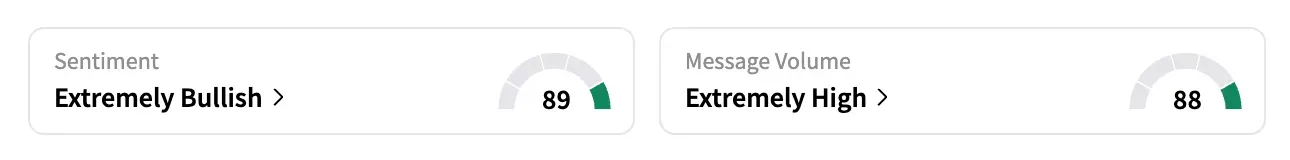

On Stocktwits, the retail sentiment for the stock was 'extremely bullish' as of early Monday, up from 'bullish' a week ago.

"$CVNA worth 7x $KMX? Carmax seems like a complete steal here," a user said.

Carmax shares are down 16.2% year-to-date.

Last month, Carvana also delivered strong quarterly results and set ambitious long-term targets, including selling 3 million vehicles annually at an adjusted EBITDA margin of 13.5% within the next five to 10 years.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)