Advertisement|Remove ads.

CarMax Stock Gets A Price-Target Cut After Q2 Miss — But Retail Traders Remain Optimistic

CarMax stock received a big price cut from Truist late Thursday, following the company's second-quarter results that missed analysts' estimates and caused shares to plummet 20%. KMX was among the top trending tickers on Stocktwits at the time of writing.

Revenue rose 6%, while net income declined 28%. Total vehicle sales were down 4.1% in the quarter. The figures showed that the tariffs-driven spike in used car demand was beginning to fade.

Truist slashed its price target on the company's shares to $47 from $74, while maintaining a 'Hold' rating. CarMax stock ended Thursday's session at $45.60, although it gained 1.5% in extended trading.

The research firm believes CarMax continues to face share challenges and argues that "the path forward looks highly uncertain," according to the investor note summary on The Fly.

Earlier in the day, Wedbush cut its rating on the stock to 'Neutral' from 'Outperform,' and lowered the price target to $54 from $84. Its analysts noted concerns around CarMax's ability to sustain market leadership and drive additional growth.

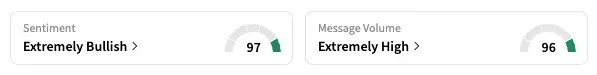

On Stocktwits, however, retail sentiment for KMX was 'extremely bullish' as of the last reading, with users seeing the stock drop as a buying opportunity.

"At $45 seems like quite the steal. They are profitable and prints cash, have a fortress of a balance sheet," said one user.

Currently, 11 of the 19 analysts covering the stock have a 'Buy' or higher rating, six rate it 'Hold,' and two rate it 'Strong Sell,' according to Koyfin data. Their average price target is $72.87.

With Thursday's drop, KMX shares are now down 44.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)