Advertisement|Remove ads.

Is Opendoor The Next GameStop? Penny Stock Triples In A Week, Retail Frenzy Takes Hold

Opendoor Technologies (OPEN) shares soared as much as 121% during intraday trading before closing up 42.6% on Monday, as retail investors drove a meme stock-style rally sparked by upbeat remarks from an investor last week.

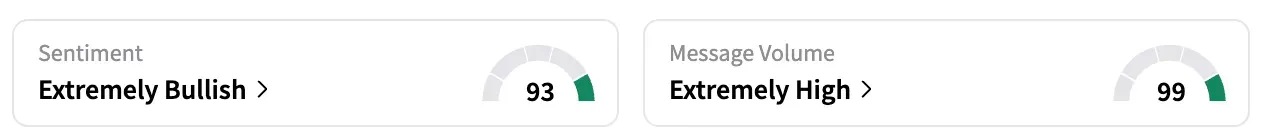

As of early Tuesday, Opendoor Technologies (OPEN) topped Stocktwits' most active tickers list, with retail investors on the platform logging an 'extremely bullish' sentiment toward the stock. Most users commented affirmatively to a Stocktwits thread asking whether they see $OPEN as the next $GME.

A Stocktwits poll that received over 6,700 responses revealed that 37% of retail traders are piling on to OPEN stock, while 28% are "watching the show" and 21% are choosing to hold.

Last week, investors lapped up shares of Opendoor after EMJ Capital founder Eric Jackson said that the stock could reach as high as $82 with changes that he recommends. He indicated that Opendoor could replicate the stock market performance of Carvana, which pioneered an online model for selling used cars.

OPEN, penny stock nearly tripled over the past week, jumping from $0.78 to $2.25, sparking a surge in discussions across social media platforms, particularly on Reddit forums like WallStreetBets.

The rally echoes the wild swings seen in GameStop (GME) during the height of the 2021 meme stock craze. Opendoor's gains on Monday helped boost other meme stocks, pushing the UBS Meme Basket, which tracks meme stocks, up 4%, Bloomberg reported.

Per Bloomberg and TradingView reports, roughly 24% of Opendoor’s shares were sold short. As the stock surged on Monday, investors rushed to buy call options, fueling volatility before the shares pulled back. Trading was briefly halted during the session amid the sharp moves.

The Opendoor saga has put the spotlight back on retail investors and penny stocks. Individual investors typically favour cheap stocks. Over 26% of all trading volume is now in stocks with a price of less than $5, according to Jefferies data shared by reporter Gunjan Banerji on X.

Opendoor's business has struggled in recent years, partly due to the sluggish U.S. housing market. Despite the recent surge, the stock is down 91% since its peak in early 2021.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)