Advertisement|Remove ads.

CBOE Global Markets Q4 Earnings Fail To Meet Wall Street Expectations: Retail’s Unimpressed

Shares of Cboe Global Markets, Inc. (CBOE) were in the spotlight on Friday after the company’s fourth-quarter earnings fell short of Wall Street estimates.

Net revenue rose 5% year-over-year (YoY) to $524.5 million compared to a Wall Street estimate of $526.93 million. Adjusted diluted earnings per share (EPS) stood at $2.10 versus an estimated $2.12. Net income declined 7% YoY to $195.6 million.

For 2024, the company reported an 8% rise in net revenue to a record $2.1 billion.

CEO Fredric Tomczyk said the company enters 2025 on solid footing, with a refined strategic focus and the financial flexibility to execute its vision. “We remain well positioned to benefit from the secular market trends to drive durable growth for shareholders,” he said.

CBOE reported record options net revenue of $324.3 million, up 3% from the fourth quarter of 2023.

North American equities’ net revenue rose 10% YoY to $94.9 million, reflecting higher net transaction and clearing fees and access and capacity fees, partially offset by a decline in industry market data fees.

Europe and APAC net revenue rose 17% YoY to $56.2 million, reflecting growth in net transaction and clearing fees and non-transaction revenues. Futures net revenue fell 7% to $30.2 million, while global FX net revenue rose 3% to $19.4 million.

CBOE expects 2025 organic total net revenue growth to be in the mid-single-digit range.

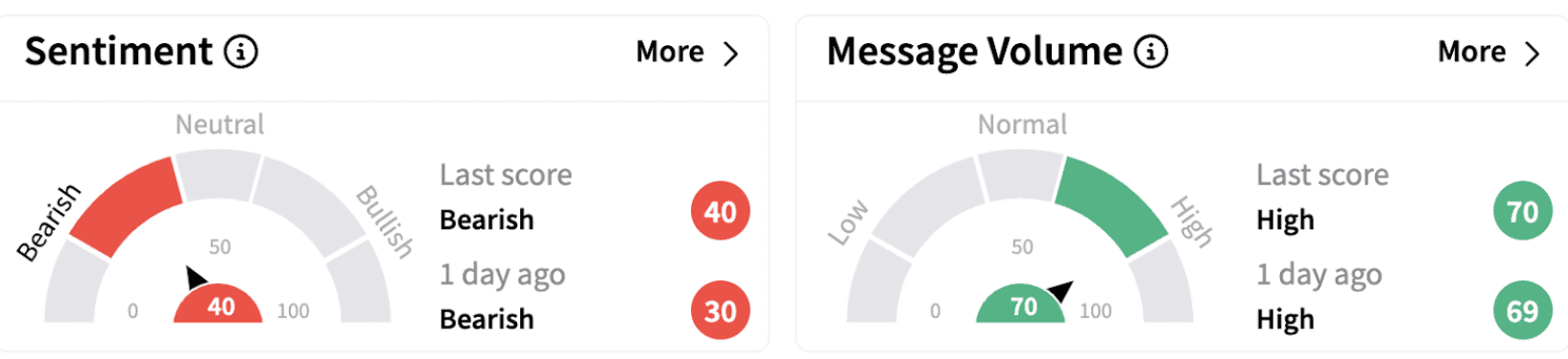

On Stocktwits, retail sentiment continued to trend in the ‘bearish’ territory (40/100), accompanied by high retail chatter.

Recently, the company announced that it plans to offer 24-hour, five-days-a-week (24x5) trading for U.S. equities on its Cboe EDGX Equities Exchange (EDGX) in its bid to meet growing global customer demand for expanded access to U.S. equities markets.

The move will expand trading opportunities for investors worldwide, enabling them to react to global macroeconomic events as they are happening, manage risk more effectively, and adjust positions around the clock.

CBOE shares have gained over 5% in 2025 and have risen over 12% over the past year.

Also See: Honeywell’s 3-Way Split Draws Mixed Response From Wall Street: Retail Exudes Confidence

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)