Advertisement|Remove ads.

Honeywell’s 3-Way Split Draws Mixed Response From Wall Street: Retail Exudes Confidence

Wall Street remains mixed on Honeywell International Inc (HON) after the firm announced its intention to split into three separate listed entities by the second half of 2026.

According to the company, the three entities—Honeywell Automation, Honeywell Aerospace, and Advanced Materials— will have distinct strategies and growth drivers. The decision comes months after activist investor Elliott Investment Management took a $5 billion stake in the firm.

Wells Fargo analyst Joseph O'Dea lowered the firm's price target on Honeywell to $220 from $240 while keeping an ‘Equal Weight’ rating on the shares.

According to TheFly, the analyst said that guidance came in below expectations, but the firm believes it could be a conservative start.

At the same time, Citi lowered its price target on the stock to $253 from $266 while keeping a ‘Buy’ rating on the shares.

The brokerage noted that the company's fourth-quarter (Q4) results were broadly solid, and it appears "cautious but constructive" toward demand bottoming.

Citi believes that although Honeywell's operating challenges could linger in 2025, its simplification should support long-term value appreciation.

Honeywell Automation is to be a pure-play automation player with a comprehensive portfolio of technologies, solutions, and software to drive customers’ productivity. In 2024, it posted revenues of $18 billion.

Honeywell Aerospace will be a premier technology and systems provider. It reported $15 billion in annual revenue in 2024.

Meanwhile, Advanced Materials' spin-off was announced earlier. The company will provide sustainability-focused specialty chemicals and materials. It reported nearly $4 billion in revenue last year.

Honeywell also highlighted that the three independent companies will be appropriately capitalized to take advantage of future growth opportunities. At the same time, Honeywell Automation and Honeywell Aerospace are each expected to maintain a strong investment-grade credit rating.

Deutsche Bank upgraded the stock to ‘Buy’ from Hold with a $260 price target, up from $236. According to TheFly, the firm agrees with management's decision to separate Aerospace from Automation, saying Honeywell's conglomerate structure "has become a burden to organic growth."

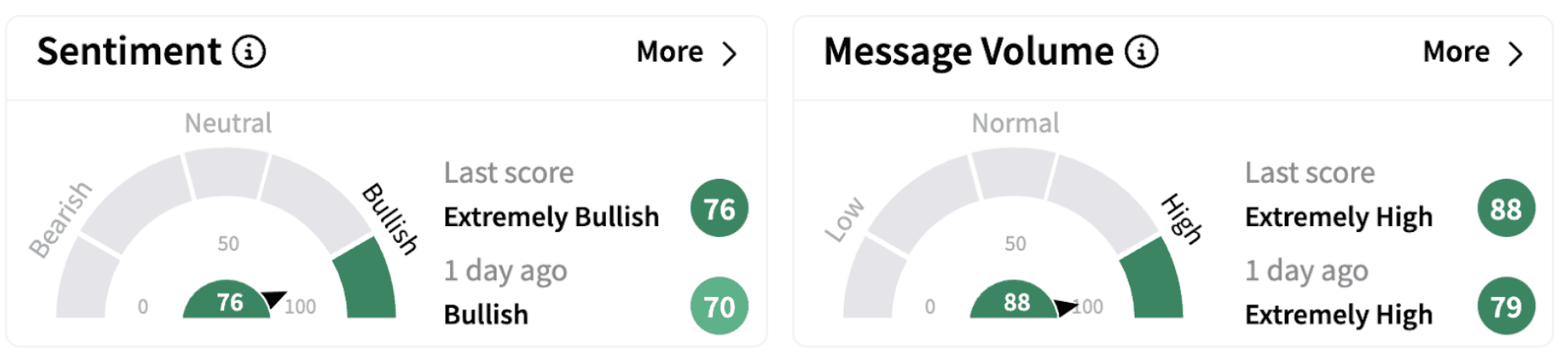

On Stocktwits, retail climbed into the ‘extremely bullish’ territory (76/100), accompanied by significant retail chatter.

Honeywell shares have lost nearly 7% in 2025 but are up over 8% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)