Advertisement|Remove ads.

CCCX Stock Rises After Shareholders Approve Infleqtion Merger With Limited Redemptions

- Churchill Capital Corp X shares rose more than 4% in overnight trading after shareholders approved all proposals related to its planned merger with Infleqtion.

- Shareholders backed the Infleqtion deal with more than 22.1 million votes in favor and limited redemptions of just 0.09% of Class A shares.

- Ahead of the vote, Barclays has cut its stake below the 5% reporting threshold.

Shares of Churchill Capital Corp X (CCCX) rose more than 4% in overnight trading on Thursday after the SPAC said shareholders approved all proposals related to its planned merger with quantum technology firm Infleqtion.

The deal stood out in the SPAC market because of its low redemption rate. The merger vote preserves nearly $551 million in expected gross proceeds and clears the path for the combined entity to list on the New York Stock Exchange, pending deal closing.

CCCX stock fell nearly 8% during Thursday’s session before rebounding almost 2% in after-hours trading.

Shareholders Greenlight Infleqtion Merger

In a new filing, Churchill Capital Corp X said it held an extraordinary general meeting on Feb. 12, where shareholders voted in favor of the proposed merger with Infleqtion, along with related proposals covering domestication, governance changes, stock issuance, incentive plans, and director elections.

Roughly 46.6% of the company’s voting power was represented at the meeting, with the merger proposal receiving more than 22.1 million votes in favor, surpassing the votes against and abstentions.

The filing showed that redemptions were limited, with only about 37,800 Class A shares redeemed, representing 0.09% of shares outstanding. As a result, just under $400,000 was removed from the trust account. Churchill expects to deliver about $551.4 million in gross proceeds to Infleqtion at closing, including about $424.8 million from the trust account and $126.5 million from a previously announced private placement.

Following approval of the domestication proposal, Churchill said it will change its jurisdiction of incorporation from the Cayman Islands to Delaware. Upon completion of the transaction, the combined company will be renamed Infleqtion, Inc. Churchill plans to apply for the post-merger company’s common stock to be listed on the New York Stock Exchange under the ticker symbol INFQ.

Barclays Cut Stake Ahead Of The Merger Vote

In a Wednesday filing, Barclays reduced its stake below the 5% reporting threshold ahead of the vote. The filing marked a reduction from Barclays’ prior disclosure in November, when the bank reported ownership of 3 million shares, or 8.63% of the company. The latest filing showed that Barclays trimmed its position by roughly 1.2 million shares, bringing its stake below the 5% reporting threshold.

Fueling The Quantum Momentum

Earlier in the week, CCCX surged more than 15% to mark its best day in about three months following Infleqtion’s announcement of a partnership with NASA to help develop the "world’s first quantum gravity sensor" into space.

Infleqtion has positioned itself as a diversified quantum technology company, with products spanning quantum sensors, clocks, RF systems, and inertial-sensing equipment. Government and state-funded entities account for more than half of its revenue, with contracts linked to areas such as energy grids and locks.

How Did Stocktwits Users React?

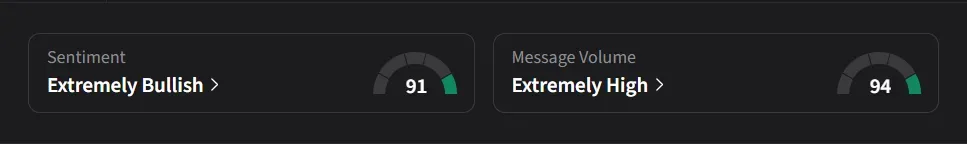

On Stocktwits, retail sentiment for CCCX was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “INFQ- Get those space suits on we going to SPACE. Literally speaking. The future looks bright. We should pass RGTI and IONQ on the way up!”

Another user said, “love that we'll have a established defense contractor supply our products for us. Infleqtion will be in subs, ships, planes, drones, etc.”

CCCX stock has declined 29% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)