Advertisement|Remove ads.

Cencora Reports Upbeat Q2 Earnings, Revises Fiscal Year 2025 Guidance: Retail’s Pleased

Shares of Cencora (COR) jumped 4% on Wednesday morning after the company reported its second quarter (Q2) earnings that trumped Wall Street expectations and revised its fiscal year 2025 guidance.

The drug wholesale company reported revenue of $75.5 billion in the quarter that ended March, marking a growth of 10.3% year-on-year, and above an analyst estimate of $75.41 billion, per Finchat data.

The company said the jump in revenue was spurred by a rise in revenue from within the U.S. Healthcare Solutions segment, which was driven by unit volume growth, including increased sales of products labeled for diabetes/ weight loss.

While revenue from the U.S. Healthcare Solutions segment jumped 11.4% to $68.3 billion in the quarter, the International Healthcare Solutions segment witnessed a 0.7% increase in revenue to $7.2 billion.

Adjusted diluted earnings per share came in at $4.42, up 16.3% from the corresponding quarter of fiscal year 2024, and above an estimated $4.09.

The company also raised its fiscal year 2025 adjusted EPS guidance to $15.70 to $15.95 compared to a previous range of $15.30 to $15.60.

The company said the new guidance reflects stronger earnings growth in the U.S. Healthcare Solutions segment and a lower contribution from the International segment.

Cencora now expects adjusted consolidated operating income growth of 13.5% to 15.5%, up from the previous range of 11.5% to 13.5%.

This growth is due to operating income growth of 17.5% to 19.5% from the U.S. Healthcare Solutions segment, offsetting an operating income decline of 1% to 4% from the International Healthcare Solutions segment.

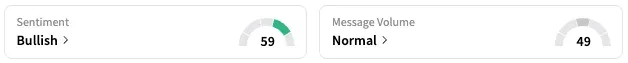

On Stocktwits, retail sentiment around Cencora jumped from ‘neutral’ to ‘bullish’ territory while message volume jumped from ‘low’ to ‘normal’ levels.

COR stock is up 34% this year and 33% over the past 12 months.

Also See: Netflix Plans To Add The Much-Loved Vertical Video Feed To Its App To Keep Users From Drifting

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)