Advertisement|Remove ads.

Chambal Fertilisers May Be Poised For Pullback If ₹560 Breaks: SEBI RA Deepak Pal

Chambal Fertilisers is on the analyst’s radar this week. The stock has been in a short-term decline recently, but technical indicators suggest a potential for some recovery.

SEBI-registered analyst Deepak Pal noted that its Parabolic SAR dots suggest a possible short-term reversal, while the stock is facing resistance near its 14 and 200-day Exponential Moving Averages (EMAs).

A simple chart pattern indicates repeated reversals from the ₹545–550 zone, creating a base. Pal adds that a small hurdle around ₹560 is visible, and if Chambal Fertilizer stock sustains above this, it may enter a correction phase, leading to an upward pullback.

He suggested that traders could consider a position with a stop loss at ₹540, targeting upside levels of ₹575.

Fundamentally, the fertiliser company has maintained stable revenues, despite facing challenges from government subsidy delays and fluctuating raw material (natural gas) prices.

Chambal Fertilisers has a moderate debt profile, stable promoter holding, and regular dividend payout.

Pal believes that with the government’s continued push for agri-reforms and domestic fertiliser production, Chambal Fertilisers is well-positioned for long-term growth in the agri-input industry.

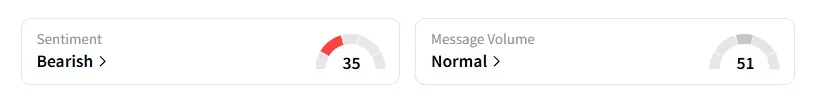

However, data on Stocktwits shows that retail sentiment is ‘bearish’ on this counter.

Chambal Fertiliser shares have risen 11% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)