Advertisement|Remove ads.

CompoSecure Eyes $5B Acquisition Of Husky Technologies: Report

- Last year, an investment group led by former Honeywell CEO David Cote and former Goldman Sachs executive Tom Knott took a majority stake in CompoSecure.

- The report also stated that the Husky deal could be the first of many that Cote and Knott might pursue.

- Husky Technologies supplies injection-moulding systems and services to the plastics industry.

CompoSecure, a firm backed by former Honeywell CEO David Cote, is reportedly looking to buy Husky Technologies, a manufacturer of injection-molding equipment, from Platinum Equity for about $5 billion, including debt.

Founded in 1953, Husky Technologies supplies injection-moulding systems and services to the plastics industry and employs over 4,300 workers across 35 locations worldwide, according to its website. Platinum Equity bought Husky from Berkshire Partners and Omers Private Equity in 2018 for roughly $4 billion.

How Would CompoSecure Finance The Deal?

According to a report by The Wall Street Journal, citing people familiar with the matter, the deal is expected to be partially financed with a roughly $2 billion so-called PIPE, or private investment in public equity, which will be offered at $18.50 per share of CompoSecure common stock.

CompoSecure, founded in 2000, is a fintech manufacturer known for its metal payment cards, serving more than 150 card programs worldwide. Last year, an investment group led by David Cote and former Goldman Sachs executive Tom Knott took a majority stake in CompoSecure, with Cote assuming the role of executive chairman following the deal’s completion.

As per the report by the Journal, $1.1 billion will come from Cote’s family office’s prior investments into CompoSecure, and Platinum would provide about $1 billion to maintain a little less than 20% stake in the combined business.

Threat To Honeywell?

The report also stated that the Husky deal could be the first of many that Cote and Knott might pursue, as they see an opportunity to combine private-equity-backed companies to create a new industrial conglomerate. Cote led Honeywell between 2002 and 2017.

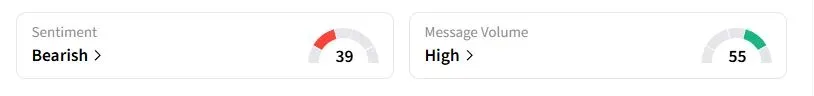

Retail sentiment on Stocktwits about CompoSecure and Honeywell was in the ‘bearish’ territory at the time of writing.

Honeywell is currently undergoing a three-way split, bowing to pressure from activist investors. Its materials business, Solstice, began trading on Nasdaq last week.

CompoSecure has gained nearly 57% this year, while Honeywell stock has fallen close to 6%.

Also See: BP To Sell Stakes In US Assets For $1.5B In Cost-Cutting Drive

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rigetti_resized_jpg_4e393f1208.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)