Advertisement|Remove ads.

Constellation Brands Share Rise Despite Weak Earnings: Retail Sentiment Drops

Constellation Brands (STZ) reported first-quarter results below Wall Street expectations on Wednesday. However, some positive comments on tariff headwind mitigation and an unchanged full-year outlook lifted shares.

Constellation stock gained 4.5% to $173.87, its best intraday gains in nearly three months. Shares are down 21.3% year-to-date.

CEO Bill Newlands said Constellation "continued to face softer consumer demand largely driven by what we believe to be non-structural socioeconomic factors.

Earlier this week, Bank of America downgraded peer Molson Coors Beverage's (TAP) shares, stating that it expects U.S. beer volumes to shrink by 4% next year, a steeper decline than its earlier prediction of a 1% decrease.

Q1 revenue at Constellation, known for Corona beer and Robert Mondavi wine, dropped 6% to $2.52 billion, slightly below analysts' expectations. Earnings per share were $3.22, also below the estimate.

Management stated that the company anticipates an approximately $20 million impact from aluminum tariffs for the remainder of its fiscal year, down from its earlier expectation of $30 million. Despite that, the company expects to maintain its targeted margin growth.

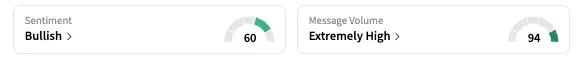

On Stocktwits, the retail sentiment for the company shifted to 'bullish' from 'extremely bullish' the previous day.

A user said, "The exuberance (in the stock) seems a bit irrational," and backed it up by saying the company faces "declining market share, declining sales, declining profit, 25% tariff on Mexican beer, customer base being deported."

Following the results, Bank of America maintained its 'Neutral' rating on STZ stock and raised the price target by $2 to $182.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)