Advertisement|Remove ads.

CorMedix Stock Breaks Out To 2-Month High: Analysts Reset Price Targets After Blowout Q3 And Surging DefenCath Demand

- Analysts delivered mixed revisions following the earnings release, with one maintaining its valuation outlook and another lowering its target after reviewing updated guidance.

- The company highlighted continued patient uptake for DefenCath, normal inventory levels, and active pricing discussions with Medicare Advantage plans.

- Upcoming clinical events include Phase III data for Rezzayo antifungal prophylaxis in 2026 and progress on DefenCath’s expansion into new indications.

CorMedix shares hit a two-month high on Wednesday as the company drew fresh analyst updates following its third-quarter (Q3) results, which were boosted by rising DefenCath demand and initial revenue from the recently acquired Melinta portfolio.

The stock closed up 2% at $11.42 on Wednesday before slipping 0.2% in after-hours trading.

D. Boral Capital maintained its price target of $14 per share, while Needham cut its target to $16 from $20 following the results. Both updates followed CorMedix’s Q3 earnings, when the company raised full-year guidance and outlined progress on its integration of Melinta and expansion of DefenCath.

Q3 Earnings Review

CorMedix reported $104.3 million in Q3 revenue, up 284% year over year, reflecting accelerating DefenCath adoption and one month of contribution from Melinta’s anti-infective portfolio. Net income rose to $108.6 million, aided by a $59.7 million tax benefit. Adjusted EBITDA reached $71.8 million, turning positive for the first time this year.

DefenCath, an FDA-approved catheter lock used to reduce bloodstream infections in adults on chronic dialysis, accounted for about 85% of the company’s quarterly revenue, the company said.

The company raised its full-year pro forma revenue outlook to $390 million–$410 million, up from earlier guidance of at least $375 million, and lifted its adjusted EBITDA guidance to $220 million–$240 million, up from $165 million–$185 million.

Pricing, Reimbursement, And Utilization

On the company’s earnings call, the company said DefenCath utilization exceeded 6,000 patients, with inventory levels normal across smaller dialysis centers and large dialysis organizations. However, it noted slight quarter-over-quarter price erosion, offset by volume growth, and said reimbursement visibility will remain dependent on the final End-Stage Renal Disease (ESRD) rule ahead of the post-Transitional Drug Add-on Payment Adjustment (TDAPA) pricing transition in July 2026.

CorMedix said anecdotal customer feedback indicated noticeable reductions in infection rates and highlighted ongoing price negotiations with Medicare Advantage plans. The company added that real-world evidence data from 2,000 patients is expected later this year.

Integration Running Ahead Of Schedule

The Melinta acquisition, closed in August, added an additional revenue stream and a late-stage pipeline. The company said integration of the Melinta acquisition is progressing ahead of expectations, with a $30 million annualized cost benefit targeted by year-end.

The unified commercial team will begin promoting both DefenCath and Melinta products in January 2026.

Upcoming Catalysts

CorMedix expects top-line data from the Phase III ReSPECT study of Rezzayo antifungal prophylaxis in the second quarter of 2026, a program with a potential market opportunity above $2 billion. The Phase III Nutri-Guard trial for patients receiving total parenteral nutrition is expected to be completed in late 2026 or early 2027.

The company’s year-end cash is projected at roughly $100 million, supported by positive operating cash flow.

Stocktwits Users Flag Possible TDAPA Extension

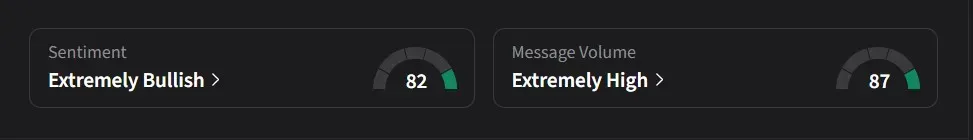

On Stocktwits, retail sentiment for CorMedix was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said they expect the CMS to extend DefenCath’s TDAPA beyond June 30, 2026, and believe an announcement of an additional one to two-year extension could come in a future press release.

Another user said they anticipated strong trading the next day, citing rising revenue, a lack of near-term acquisition plans, and additional potential indicators as reasons for optimism.

CorMedix’s stock has risen 41% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364715_jpg_59427544e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)