Advertisement|Remove ads.

Cisco Stock Hits 13-Month High After Citi Upgrade: Retail Confidence Grows

Shares of Cisco Systems, Inc. ($CSCO) surged over 2% on Wednesday, reaching a new 52-week high of $55.72, levels last seen in September 2023, lending some cheer to retail investors as well.

The rally came after Citi upgraded Cisco to ‘Buy’ from ‘Neutral’ and raised its price target to $62 from $52.

Citi’s analysts pointed to the growing total addressable market for Ethernet in artificial intelligence (AI) and a narrowing valuation gap between Cisco and its peers as key drivers for the upgrade.

While AI remains a small part of Cisco’s current business, Citi sees the potential for it to play a larger role in the future.

The brokerage also expects investors to rotate from semiconductor and hardware stocks into networking equipment, which positions Cisco to benefit from this shift.

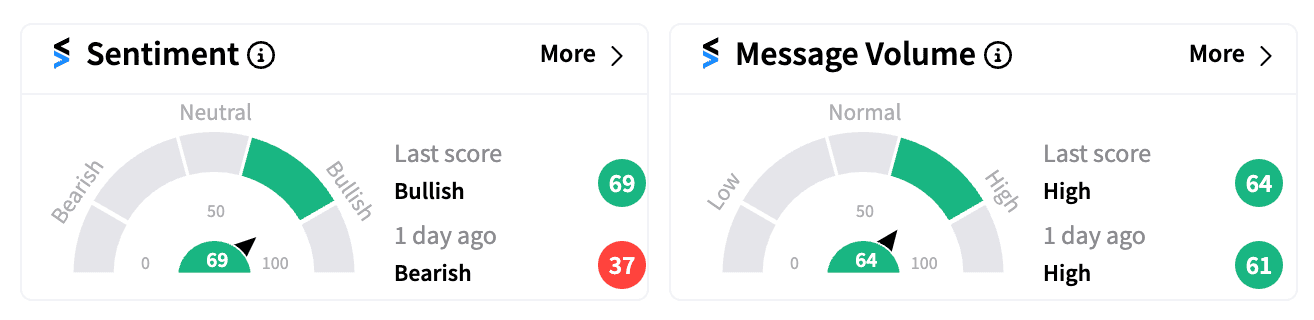

Retail sentiment on Stocktwits turned ‘bullish’ from ‘bearish’ as message volume increased.

One user noted their prediction of Cisco hitting this level was off by a few weeks but expressed confidence in the stock’s momentum.

Another commented on bullish order flow, suggesting the stock could soon challenge its next resistance level at $58.19.

Further bolstering confidence, Tigress Financial analyst Ivan Feinseth recently raised his price target on Cisco to $78 from $76, reiterating a ‘Buy’ rating.

Feinseth believes Cisco will continue to benefit from growing demand for AI-driven high-speed networks and its transition to a subscription-based revenue model, which should drive long-term shareholder value.

As part of its broader strategic shift, Cisco announced in August that it plans to cut jobs as part of a realignment toward cybersecurity, cloud systems, and AI-related products — areas the company sees as critical to future growth.

The company also projected fiscal Q1 2025 sales of $13.65 billion to $13.85 billion, above Wall Street expectations.

Cisco is set to report its Q1 FY’25 earnings on Nov. 13, with analysts expecting earnings per share (EPS) to drop to $0.87 from $1.11 in the same period a year ago.

Despite the stock rising over 10% year-to-date, it has underperformed the broader S&P 500 and Nasdaq indices. However, with its strategic pivot and investor optimism building, Cisco appears to be positioning itself for continued growth.

Read next: 180 Life Sciences Turns Retail Heads With Online Gaming Entry, Stock Surges 500%

/filters:format(webp)https://news.stocktwits-cdn.com/large_tandem_diabetes_resized_jpg_5f199c73c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_applovin_OG_jpg_12b141cd06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robinhood_jpg_ffd49b668a.webp)