Advertisement|Remove ads.

D-Wave Vs. IonQ Vs. Rigetti: Retail Traders Reveal Which Quantum Computing Stock They’re Most Bullish About

Quantum computing stocks, which had a stellar run in late 2024, have turned mixed this year amid investor caution about their fundamentals and the near-to-medium-term potential.

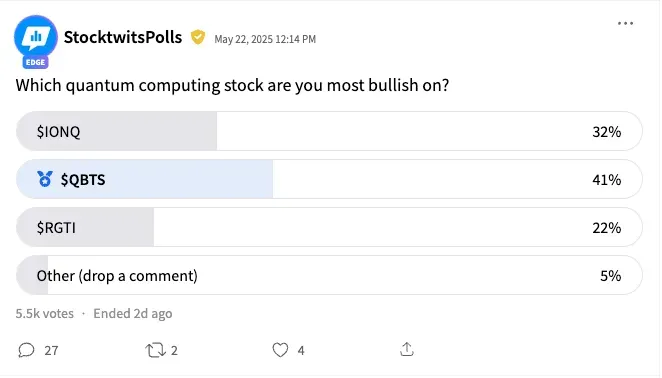

Against the backdrop, we asked Stocktwits users regarding the quantum computing stock they were most bullish about.

The poll, which received responses from 5,500 users, found that D-Wave Quantum, Inc. (QBTS) elicited bullish reactions from most users (41%). IonQ, Inc. (IONQ) was mentioned by 32% of the respondents, and Rigetti Computing, Inc. (RGTI) by 22%.

A bullish watcher contended that D-Wave has demonstrated and achieved “Quantum Supremacy," while it has reported 10 times the revenues of Rigetti in the first quarter of 2025 and two times the revenue of IonQ.

Not all shared an upbeat outlook toward D-Wave stock. A skeptic said it was not a quantum computing company, adding that the GameStop/Reddit people have moved it up. “That's usually my sell signal,” they said.

Several users threw up alternatives. A watcher said SEALSQ Corp. (LAES) stock has lots of room to move up. They also noted that SEALSQ is a quantum encryption company that does not compete with IonQ, D-Wave, or others. Another user saw the stock moving to the $20-$40 level.

A respondent said International Business Machines Corp. (IBM), though a non-pure quantum play, is also a player in the quantum arena.

Quantum eMotion Corp. (QNCCF) stock also found takers, with one naming it as the next “10x banger.”

Among the other names mentioned were Alphabet, Inc. (GOOGL) (GOOG), which announced its in-house quantum chip Willow late last year; Quantinuum, a privately held company owned by Honeywell (HON) and Cambridge Quantum; MicroAlgo, Inc. (MLGO); and MicroCloud Hologram, Inc. (HOLO).

Some expressed skepticism regarding the technology per se. “The tech is 10 years out at least and requires multiple scientific breakthroughs,” a user said.

“It'll still be an enormous challenge to implement the scientific breakthroughs, and those breakthroughs may still miss key parts required for commercial viability.”

Wall Street firms, however, are not optimistic about D-Wave. According to Koyfin, Wall Street analysts’ average price target for D-Wave suggests a downside of about 32% from current levels.

IonQ stock’s one-year return potential is a negative 13%, while Rigetti stock has a positive 6% return.

The Defiance Quantum ETF (QTUM), an exchange-traded fund (ETF) that tracks liquid companies in the quantum computing and machine learning industries, has gained 6.3% year-to-date.

The YTD gains of the key pure-play quantum computing stock are:

- D-Wave - +123%

- IonQ - +9%

- Rigetti - (-8%)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)