Advertisement|Remove ads.

Dan Ives Calls Palantir’s Commercial Business Surge A ‘Major Validation Moment’

- Palantir’s U.S. commercial business surged 121% year-over-year (YoY), outpacing Wall Street’s forecast of 85% growth.

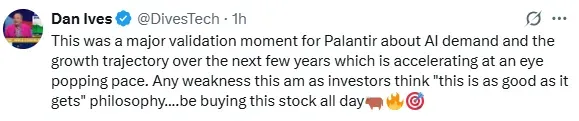

- In a post on the X platform, Ives highlighted that Palantir’s latest performance signals momentum in the AI space.

- Goldman Sachs and Bank of America raised their price targets after Q3 earnings.

Palantir Technologies Inc. (PLTR) received strong praise from Wedbush’s Dan Ives after reporting robust growth in its U.S. commercial segment in the third quarter (Q3), underscoring rising demand for artificial intelligence-driven solutions.

Ives described the results as a “major validation moment” for the company’s AI strategy and long-term outlook.

Strong Commercial Growth

In a post on the X platform, the analyst highlighted that Palantir’s latest performance signals accelerating momentum in the enterprise AI space, suggesting the firm’s growth path is expanding rapidly.

Palantir’s U.S. commercial business surged 121% year-over-year (YoY), significantly outpacing Wall Street’s forecast of 85% growth, cited Ives. The company also reported a total commercial contract value of $1.31 billion, marking a 342% YoY surge, while total remaining U.S. deal value reached $3.63 billion.

Palantir’s stock traded 7% lower in the premarket on Tuesday and was the top-trending equity ticker on Stocktwits. Retail sentiment around the stock remained in ‘extremely bullish’ territory. Message volume improved to ‘extremely high’ from ‘high’ levels in 24 hours.

Wall Street Firms Raise Price Targets

In Q3, Palantir’s revenue of $1.18 billion and adjusted earnings per share (EPS) of $0.21 both surpassed the analysts' consensus estimates of $1.09 billion and $0.17, respectively, according to Fiscal AI data.

Goldman Sachs lifted its price target on Palantir to $188 from $141 while maintaining a ‘Neutral’ rating, according to TheFly. The firm noted that Palantir is among a select group of software providers already seeing tangible revenue gains from AI adoption across industries.

Bank of America raised its target price to $255 from $215 while reiterating a ‘Buy’ rating. The firm highlighted Palantir’s distinctive approach to AI implementation, specifically its “red pill” boot camps and Ontology-driven framework that prioritizes measurable returns on investment.

Additionally, on Tuesday, Palantir announced a strategic agreement to establish its first joint venture in the UAE with Dubai Holding.

Palantir stock has gained over 173% in 2025 and over 400% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)