Advertisement|Remove ads.

Deere Stock Draws Retail Chatter After Q2 Beat, Sees Pre-Tax Tariff Impact Of Over $500M In 2025

Deere & Co (DE) stock rose 3.8% on Thursday after the company topped Wall Street’s expectations for second-quarter earnings.

The farm equipment maker reported quarterly net income of $1.80 billion, or $6.04 per share, a decline from $2.37 billion, or $8.53 per share, a year earlier. However, according to Koyfin data, it topped analysts’ expectations of $5.62 per share.

Its net sales of $11.17 billion for the quarter ended April 27, topped estimates of $10.79 billion.

The company said that crop prices have generally stabilized, albeit at lower profitability levels due to tight stocks driven by better-than-expected consumption and lower-than-expected crop production.

However, sales of large farm equipment, such as tractors and combines, have slowed as farmers navigate a still-elevated interest rate environment.

Deere said lower production costs, warranty expenses, and better price realization slightly offset lower sales. The company has adjusted its production amid high inventory levels and tepid demand.

However, President Donald Trump’s tariffs continue to beat down the company’s margins. Deere expects a pre-tax tariff impact in fiscal year 2025 of just over $500 million.

Chief Executive Officer John May said Deere is prepared to invest $20 billion in the U.S. over the next decade.

The company cut the lower end of its 2025 forecast and projected net income between $4.7 billion and $5.5 billion, compared with its prior earnings forecast between $5 billion and $5.5 billion.

“Despite the near-term market challenges, we remain confident in the future,” said CEO John May.

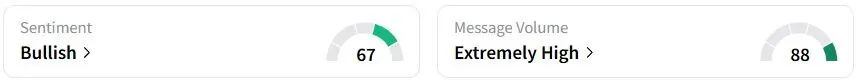

Retail sentiment on Stocktwits was in the ‘bullish’ (67/100) territory, while retail chatter jumped 231%.

One bullish trader saw a boom coming in U.S. agriculture due to trade deals by Donald Trump.

Deere stock has gained 21.2% year to date (YTD).

Also See: Birkenstock Raises Annual Profit Forecast: Shares, Retail Sentiment Surge

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)