Advertisement|Remove ads.

Diamondback Energy To Acquire Certain Subsidiaries Of Double Eagle IV Midco In $4.08B Deal: Retail Gets More Bullish

Diamondback Energy, Inc. (FANG) shares traded nearly 1% higher in Tuesday’s pre-market session after the company said it will acquire certain Double Eagle IV Midco subsidiaries in a cash-and-stock deal expected to close on April 1.

The deal will help Diamondback Energy gain access to 40,000 net acres in the core of the Midland Basin, which is the eastern sub-basin of the Permian Basin.

The transaction will be conducted in exchange for approximately 6.9 million shares of Diamondback common stock and $3 billion of cash. At Friday’s closing price of $156.99 apiece, the total value of the deal is approximately $4.08 billion.

The cash portion will likely be funded through a combination of cash on hand, borrowings under the company’s credit facility, and/or proceeds from term loans and senior notes offerings.

The company has also committed to sell at least $1.5 billion of non-core assets to accelerate debt reduction. Diamondback expects to reduce net debt to $10 billion and maintain leverage of $6 billion to $8 billion over the long term.

Diamondback and Double Eagle have also agreed to accelerate development on some of the former’s non-core southern Midland Basin acreage.

CEO Travis Stice said that Double Eagle is the most attractive asset remaining in the Midland Basin.

“With 407 locations adjacent to our core position, this largely undeveloped asset adds high-quality inventory that immediately competes for capital. Additionally, we see value uplift to our existing inventory as acreage overlap allows for meaningful lateral length extensions and infrastructure synergies,” he said.

The transaction is valued at approximately 5.2 times 2025 earnings before interest, tax, depreciation, and amortization (EBITDA) and also enhances expected pro forma 2026 free cash flow per share by over 5%.

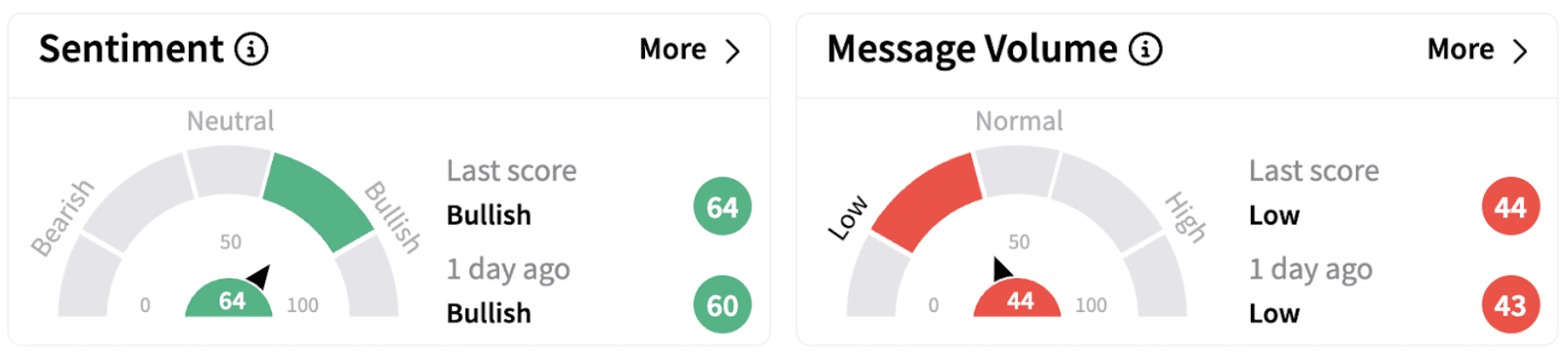

On Stocktwits, retail sentiment climbed further into the ‘bullish’ territory (64/100).

Stocktwits' retail chatter indicated a positive take on the stock.

Diamondback shares have fallen nearly 6% in 2025 and are down about 12% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)