Advertisement|Remove ads.

Disney Stock Rises As Investors Savor Q1 Beat, In-line FY25 Guidance: Retail Thrilled

Walt Disney Co.’s (DIS) stock rose in Wednesday’s premarket session after the entertainment giant reported better-than-expected fiscal year 2025 first-quarter results. Investors shrugged off a modest subscriber loss for the Disney+ streaming business and guidance for a further dip.

Burbank, California-based Disney reported first-quarter earnings per share (EPS) of $1.76, up from $1.22 a year earlier, and above the estimate of $1.45.

Revenue increased 5% year over year to $24.7 billion, higher than the $24.67 billion Street estimate.

Entertainment business revenue grew 9% to $10.87 billion, thanks to a 34% jump in content sales and licensing.

Direct-to-Consumer (DTC) revenue was up a more modest 9% to $6.07 billion.

Disney+ paid subscribers count fell 1% to 124.6 million but average monthly revenue per paid subscriber increased 5% to $7.55.

A Stocktwits poll conducted ahead of the quarterly results showed 67% of the respondents said the biggest factor impacting Disney’s quarterly results will be “streaming subscriber growth.”

The DTC business, which also includes Hulu, reversed to an operating income of $293 million from a loss of $138 million.

CEO Bob Iger said, “In fiscal Q1 we saw outstanding box office performance from our studios, which had the top three movies of 2024.”

Experiences revenue grew 3% to $9.42 billion, while Sports revenue remained flat at $4.85 billion.

Disney’s segment operating income climbed 31% to $5.1 billion, with Entertainment witnessing a 95% jump.

Looking ahead, Disney guided to a modest YoY decline in Disney+ subscribers and it expects Sports segment operating income to be adversely impacted by about $150 million.

The company estimates Disney Cruise Line pre-opening expense of about $40 million in the second quarter.

The company guided to high-single-digit adjusted earnings per share growth for the full year 2025, in line with the 8.8% growth the consensus currently models. It expects double-digit segment operating income growth for the entertainment segment, 13% for Sports, and 6% to 8% for Experiences.

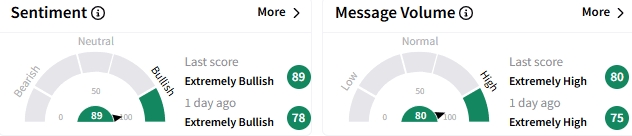

On Stocktwits, sentiment toward Disney stock stayed ‘extremely bullish’ (89/100) and message volume rose to ‘extremely high’ levels.

An optimistic user said the outlook for Disney Parks is "gangbusters,” while another remarked the company can stem Disney+ subscriber losses by streaming the top movies.

In premarket trading, Disney stock climbed 1.70% to $115.23. The stock is up 1.7% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)