Advertisement|Remove ads.

Trump Media Stock Dominates Major Retail Watcher Growth Charts As 2024 US Election Day Nears

Trump Media & Technology Group Corp. ($DJT) has seen the highest surge in watchers among the top 300 stocks based on their 30-day moving averages, according to Stocktwits data.

DJT witnessed a staggering 22,792% surge in watchers, significantly surpassing Airship AI Holdings Inc. ($AISP), which ranked second with an increase of 11,844% in the year leading up to the 2024 US election.

It has consistently been among the top 10 most active stocks on the platform in October. The stock fell 11% by mid-day trading on Thursday, following an earlier drop of nearly 14% when trading was halted for the second time this week due to high volatility.

Republican presidential candidate Donald Trump owns nearly 57% of the company and has committed not to sell his shares, despite the company reporting over $340 million in losses with revenues below $2 million in the first half of the fiscal year.

The company nevertheless has achieved an $8 billion market capitalization, which highlights a risk for traders. If Trump loses the 2024 US election, it’s not clear what will happen to the Truth Social platform that Trump Media operates.

Many of its retail investors are reportedly Trump supporters, driven either by support for the candidate or speculation on his prospects against Democratic nominee Kamala Harris.

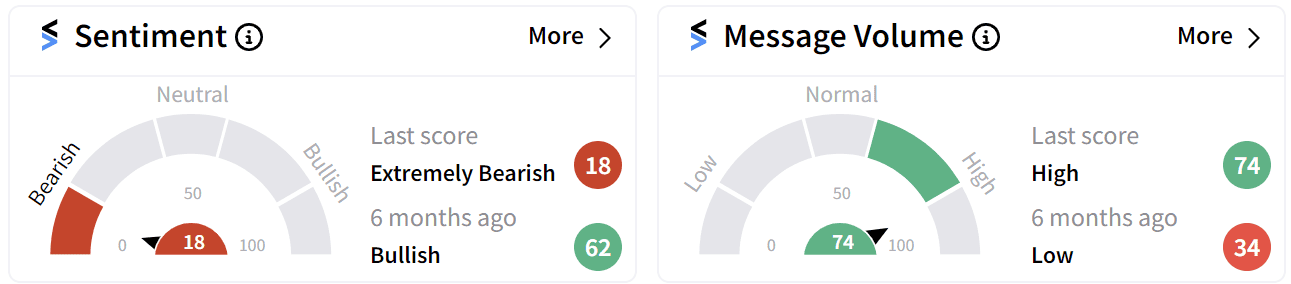

This interest could be a factor in the nearly 2,000% rise in message volume over the past year on Stocktwits, along with a 1,300% increase in average daily page views and a 2,200% surge in daily watchlist additions.

Retail sentiment for DJT has sharply declined into the 'extremely bearish' zone (18/100), a stark contrast from six months ago when sentiment was predominantly ‘bullish’.

The company, which operates the Truth Social platform, went public via a merger with Digital World Acquisition Corp. (DWAC) in March.

The stock has been highly volatile since its Nasdaq debut, reflecting retail sentiment closely tied to Trump’s political standing and broader market speculation around his potential win.

DJT’s shares have more than doubled in value so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)