Advertisement|Remove ads.

DJT, PHUN, RUM: Which Trump-Linked Stock Saw Maximum Retail Buzz Spike In October?

With the 2024 U.S. presidential election just days away, market watchers are closely eyeing stocks linked to Republican contender Donald Trump as potential indicators of his re-election chances.

Trump Media & Technology Group ($DJT), Phunware Inc. ($PHUN), and Rumble Inc. ($RUM) have each seen retail attention spike, though at varying levels.

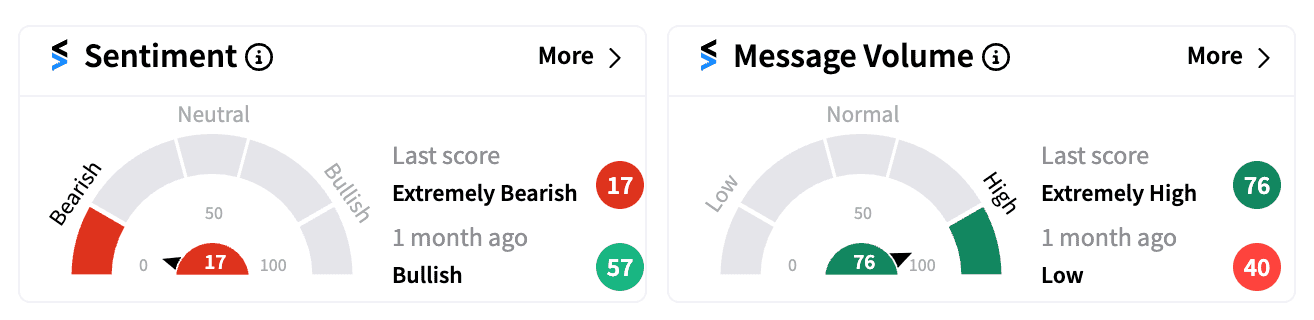

Trump Media & Technology Group Corp.

The company behind Truth Social has more than doubled its stock price in October, boosted by Trump’s rallies, endorsements from big names (including Tesla CEO Elon Musk) and favorable poll numbers.

On Stocktwits, DJT’s follower count rose by over 7%, while message volume surged 217% in October.

However, retail sentiment has shifted from ‘bullish’ to ‘extremely bearish’ over the past month, as investors took profits after the rally and amid concerns about fundamentals.

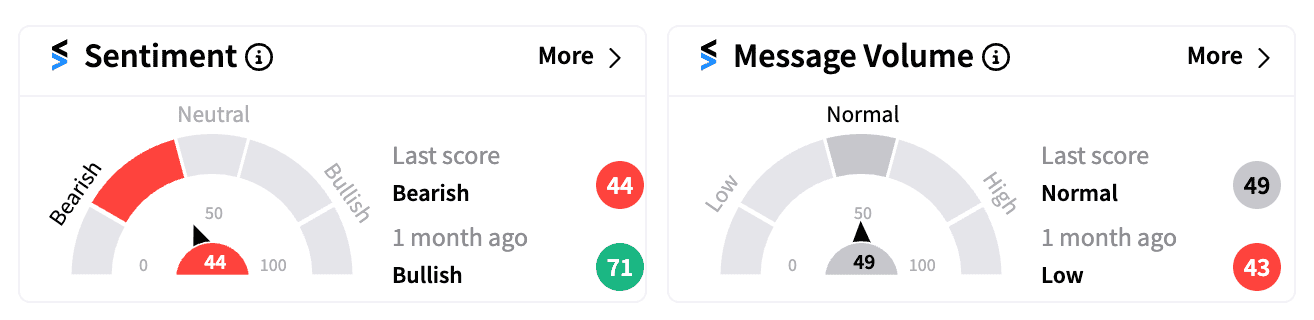

Phunware Inc.

Phunware, known for developing a mobile app for Trump’s 2020 re-election campaign, saw its shares nearly double in October, partially driven by the launch announcement of its AI-powered SaaS platform.

Retail activity on Stocktwits saw a more significant leap, with new watchers up over 5% and message volume skyrocketing 2500%.

Sentiment has turned ‘bearish’, down from last month’s ‘bullish’ stance, following CEO Mike Snavely’s retirement after just a year at the helm.

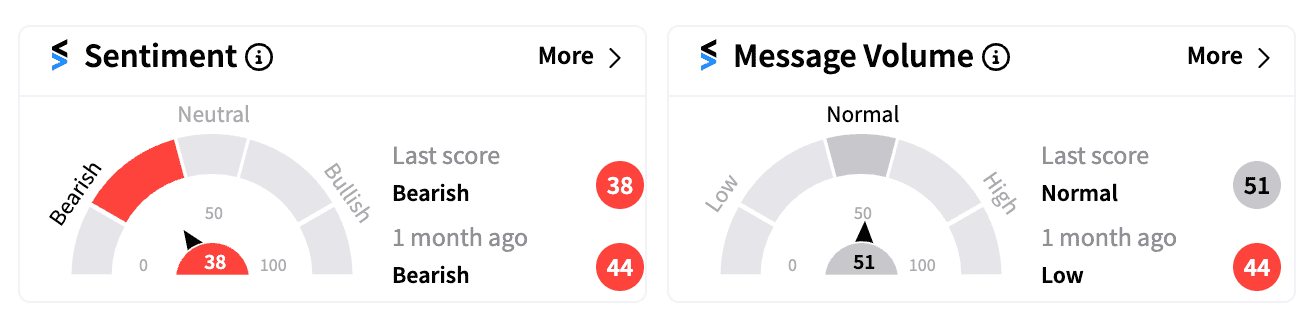

Rumble Inc.

Rumble, the conservative video-sharing platform backed by prominent investors such as Peter Thiel and from Trump's running mate, Sen. J.D. Vance of Ohio, has seen only a modest 7% gain so far this month, trailing other Trump-linked stocks in October.

Its Stocktwits following grew by over 4%, with message volume rising more than 330% this month.

Retail sentiment currently remains ‘bearish’, consistent with last month’s levels.

Verdict

Phunware saw the largest surge in retail chatter in October, with a message volume increase of 2500%, followed by DJT with a 217% rise and Rumble with 330%, making PHUN the top-trending Trump-linked stock among retail investors in October.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)