Advertisement|Remove ads.

Apollo-Backed Edgio’s Stock Crashes 80% On Bankruptcy Filing: Retail Is Frustrated

Private equity giant Apollo Management-backed firm Edgio Inc (EGIO) has filed for Chapter 11 relief in the United States Bankruptcy Court for the District of Delaware. Shares of the software firm plummeted nearly 80% on Monday following the disclosure.

Edgio has entered the process with the support of its primary lender, Lynrock Lake Master Fund. The company said it has entered a stalking horse asset purchase agreement with Lynrock, which has agreed to acquire its assets through a credit bid in the amount of $110 million of the existing secured debt held by it.

The firm said it intends to use a court-supervised sale process to seek the highest or the best bid for its assets.

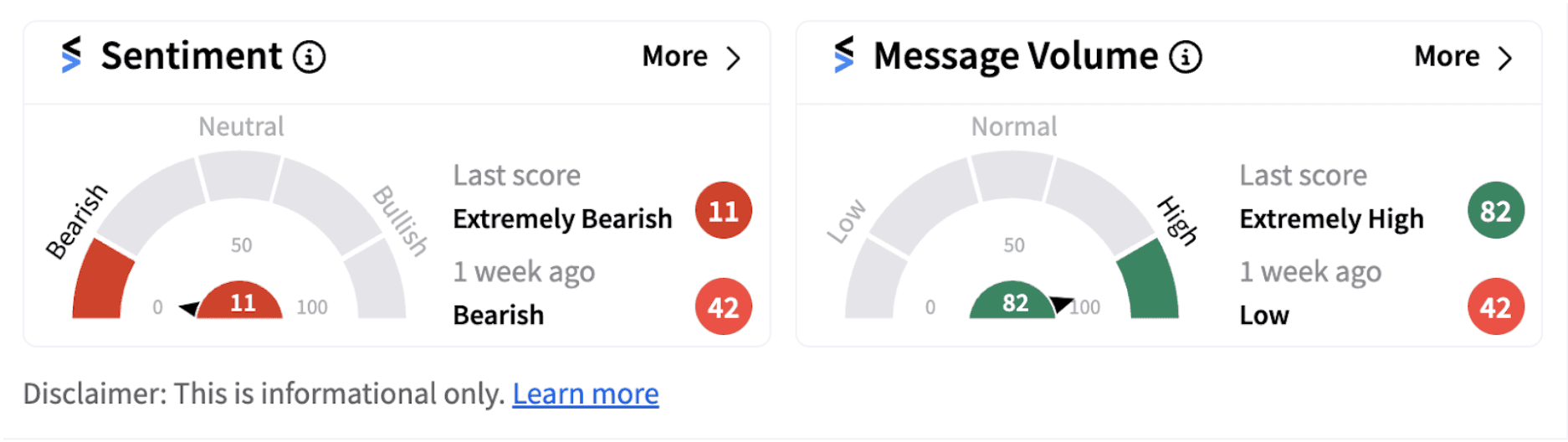

Not surprisingly, retail sentiment on Stocktwits worsened and dipped into ‘extremely bearish’ territory (11/100) from the ‘bearish’ zone a week ago, accompanied by ‘extremely high’ message volumes.

Edgio has also entered into an agreement to receive approximately $15.6 million in principal amount of funded debtor-in-possession (DIP) financing from Lynrock. The firm expects the fund to ensure continuity of delivering its products to customers in the ordinary course throughout the sale process and Chapter 11 cases.

In late August, Edgio received a written notice from Nasdaq stating that the firm is not in compliance with the requirements for continued listing. Notably, the stock has lost over 90% of its value since the beginning of the year.

On Stocktwits, followers of EGIO aren’t happy about the firm’s bankruptcy filing. Some are questioning the management on the lack of adequate notice about the possibilities of such a step.

Others expect the stock to fall below the $1 mark.

Edgio isn’t the only firm to be in the spotlight for wrong reasons. On Monday, discount retailer Big Lots (BIG), too, notified about its Chapter 11 bankruptcy proceedings in the U.S. Bankruptcy Court for the District of Delaware. The company said it has entered into an agreement with an affiliate of Nexus Capital Management under which Nexus will acquire its assets and ongoing business operations.

Also See: JetBlue Stock Soars On BofA Upgrade, Price-Target Boost: Retail Unconvinced

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Dimon_July_b5bbf1a09d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)