Advertisement|Remove ads.

Energy Sector Tanks In April Amid Oil's Worst Drop Since COVID-19 Pandemic On Trump Tariff Woes, Supply Glut

The energy sector was April's worst performer, lagging behind other struggling asset classes, such as equities in the United States and Asia, as oil prices saw their steepest monthly decline since 2021, when the COVID-19 pandemic roiled global markets.

West Texas Intermediate crude oil futures fell about 18% in the previous month after Saudi Arabia, leading the OPEC+ producer group, agreed to a bigger-than-expected production hike.

Oil prices have also been affected by concerns about a global recession due to the ongoing trade war.

United States President Donald Trump imposed reciprocal tariffs on all imports on April 2, prompting China to retaliate with its own tariffs on U.S. goods.

Several analysts have forecast that benchmark crude will remain below $65 per barrel in 2025, a price level at which oil producers cannot raise production.

The oil demand outlook threatens to undermine Trump’s goal of achieving energy dominance. The Republican President had extensively campaigned on the slogan “drill, baby, drill” and signed an executive order to boost U.S. fossil fuel production on his first day in office.

However, executives of oilfield services firms have already flagged declining activity in North America.

“In this environment, commodity prices are challenged and until they stabilize, customers are likely to take a more cautious approach to near-term activity and discretionary spending,” Olivier Le Peuch, the CEO of top oilfield services firm SLB, said last week.

The Energy Select Sector SPDR Fund (XLE) and Vanguard Energy ETF (VDE) fell 12.7% and 12.5%, respectively, over the past month.

Another oilfield firm Baker Hughes forecasted global upstream spending to be down by high-single-digit percentage points in 2025.

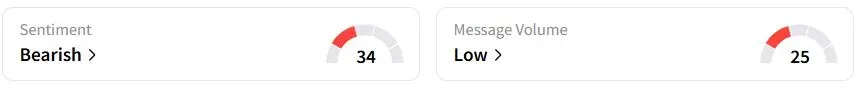

Retail sentiment on Stocktwits about XLE was in the ‘bearish’ (34/100) territory, while retail chatter was ‘low.’

Exxon Mobil (XOM), Chevron (CVX), ConocoPhillips (COP), and Occidental Petroleum (OXY) fell between 10.3% and 18.6% over the past month.

Also See: Nvidia CEO Cautions China Not Behind In AI Capabilities: ‘We Are Very Close’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rigetti_resized_jpg_4e393f1208.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)