Advertisement|Remove ads.

Fed’s Preferred Gauge Of Inflation In January Aligns With Expectations, Traders Keep Fingers Crossed For June Rate Cut

The personal consumption expenditures (PCE) index, the Federal Reserve’s preferred gauge of inflation, fell marginally in January, easing concerns that the Trump administration’s tariff policy might upend the central bank’s efforts to control price rises.

PCE for January increased 0.3% compared to the previous month and rose 2.5% from the same month one year ago. In December, the annual figure stood at 2.6%.

Core PCE, which excludes food and energy prices, rose 0.3% from the previous month and increased 2.6% from January 2024. According to a CNBC report, all figures aligned with Dow Jones estimates. Notably, annual core PCE fell to a seven-month low.

According to the CME FedWatch Tool, traders have increased their bets on a 25 basis point rate cut to as early as June 2025. At one point, traders weren’t betting on a rate reduction until October.

The U.S. Bureau of Economic Analysis also noted that personal income increased $221.9 billion in January, while personal outlays – the sum of PCE, personal interest payments, and personal current transfer payments – decreased $52.7 billion.

Following the release of the PCE index report, benchmark indices traded in the green on Friday morning. The SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust, Series 1 (QQQ) rose over 0.5%.

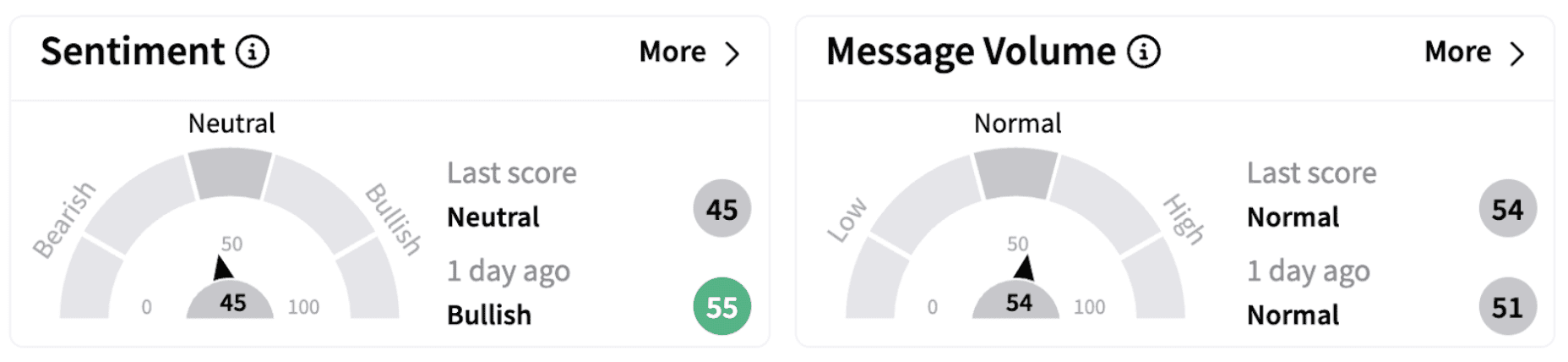

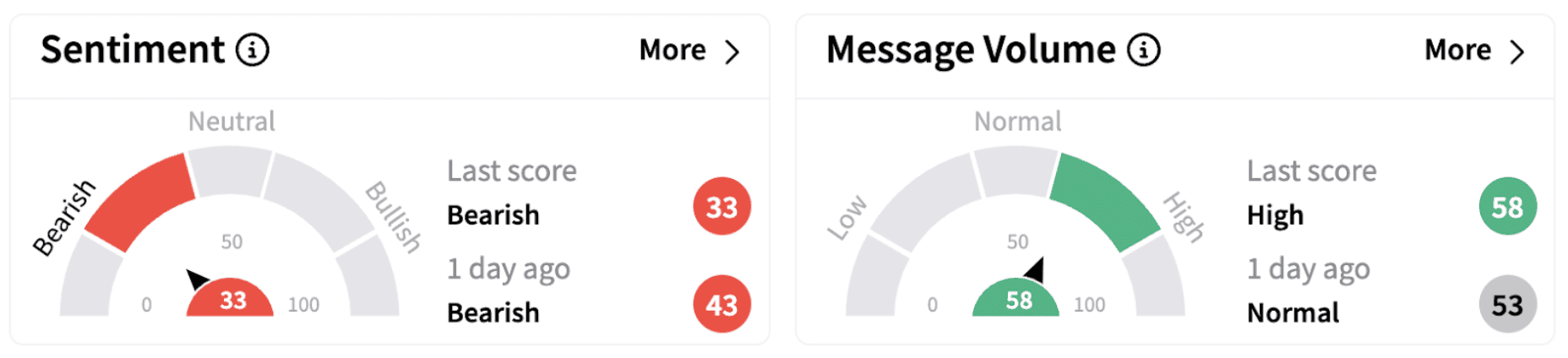

Retail sentiment surrounding these ETFs trended in the ‘neutral’ to ‘bearish’ territories.

The SPY has gained 0.58% in 2025, while the QQQ has fallen over 1% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nintendo_switch_2_jpg_bccd766d3b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245602336_jpg_dcf0764466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_3_jpg_3ea694b5e1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240006388_jpg_320990af67.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)