Advertisement|Remove ads.

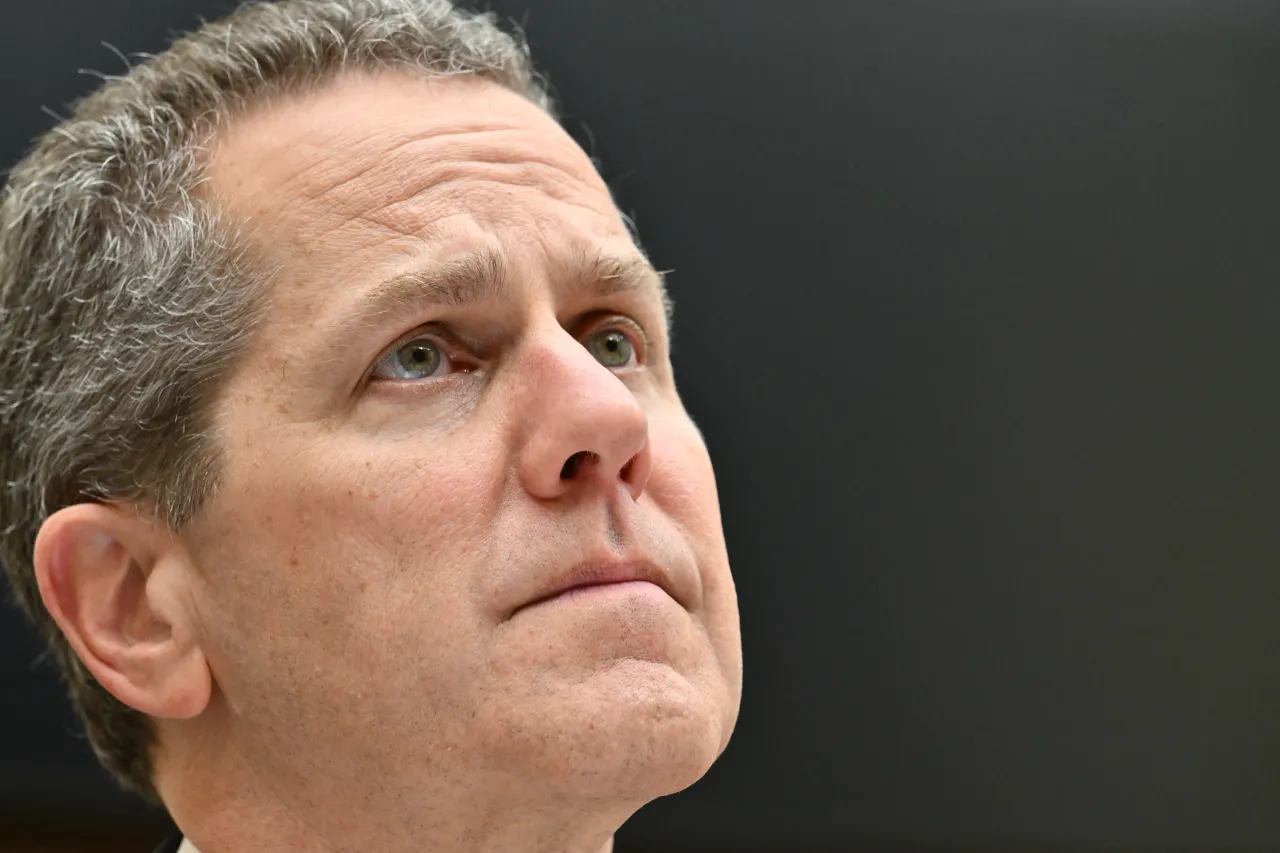

Fed’s Michael Barr Says AI Has Potential To Raise Output Without Stoking Long-term Inflation But Warns About Perils Of Excessive Capex

- The Fed official said the wave of data center investment points to signs of confidence that AI use at scale across the economy is imminent.

- Barr acknowledged the increasing adoption of AI in the financial sector.

- However, he conceded that ensuring AI is appropriately used poses a challenge.

Federal Reserve Governor Michael Barr said that artificial intelligence (AI) could boost productivity and output without triggering long-term inflation, even as he warned that the wave of AI-driven capital spending may be outpacing demand. Speaking at the Singapore Fintech Festival on late Tuesday, he delved into the transformational potential of artificial intelligence (AI).

AI – Necessary But Risky

Referring to the wave of data center investment that has begun, Barr said it pointed to signs of confidence among leading AI companies that the use of AI at scale across the economy is imminent. “If they're right and AI is useful enough to keep what is currently projected to be $3 trillion of new data center capacity utilized effectively, we can expect significant changes in economies.”

According to the Fed official, capital spending generally raises labor productivity and offers the potential for higher output growth without stoking inflationary pressure in the longer term.

However, Barr also highlighted the risk that is now at the forefront of investors' minds. “It may be the case instead that investment exceeds short-term demand, in which case there may be losses and adjustments to the AI sector.”

Mainstream banks and hedge fund investors have stepped up the rhetoric about an AI bubble bursting, especially as big tech companies invest massive amounts of money in AI infrastructure. Short seller Michael Burry, who recently emerged from a nearly two-year social media sabbatical, has been issuing warnings front and center about an imminent crash.

Investor Optimism Is Still High

Despite the apprehensions, investors continue to stay invested in AI names. The Global X Artificial Intelligence & Technology ETF (AIQ) and the Invesco QQQ Trust (QQQ) ETF have gained about 34% and 22%, respectively, year-to-date. AI darling Nvidia’s stock is up about 44%.

AI In The Financial Sector, Central Banking

Barr also acknowledged the increasing adoption of AI in the financial sector, but ensuring that AI is used appropriately poses a challenge. He recognizes the need for substantial organizational changes in the financial services industry to utilize generative AI (GenAI) effectively. Additionally, the central bank official expects practical constraints of ensuring that the resulting processes and outcomes are consistent with relevant laws and appropriate risk management.

Barr said the Fed has focused on ensuring that it can leverage AI capabilities by establishing an AI program and governance framework for the use of AI technologies. “Given AI's current and prospective role in economic activity, we are devoting the necessary resources to understanding it, including by analyzing not only AI's economic and financial implications, but also exploring how AI can enhance our financial stability work, strengthen supervisory and regulatory capabilities, and ensure the smooth functioning of our payment systems.”

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)