Advertisement|Remove ads.

From Breakouts To Reversal: SEBI RA Gunjan Kumar Flags These Four Stocks For Potential Uptrend

SEBI-registered analyst Gunjan Kumar sees CarTrade and CEAT displaying bullish technical signals, supported by robust underlying fundamental strength. The analyst also added NTPC and DLF to the F&O watchlist.

CarTrade Tech

From a fundamental perspective, CarTrade Tech remains robust, Kumar said. It has remained nearly debt-free and has generated over 115% return on investment in the past year.

In the fourth quarter, it reported its second-highest revenue along with record profits. Foreign institutional investors (FIIs) had increased their stake during the period.

On the technical front, the stock has breached a key trendline. The analyst recommends traders keep an eye out for a move above ₹1,850, with ₹1,649 acting as crucial support.

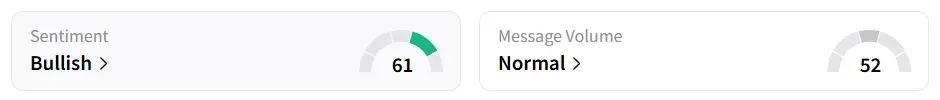

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier.

At the time of writing, CarTrade stock was down 2.5% at ₹1,762.9. It has gained 19% year-to-date (YTD).

CEAT

CEAT appears undervalued fundamentally, having posted its highest-ever revenue in the recent quarter, Kumar said. Domestic institutional investors have steadily increased their stake for eight consecutive quarters, reflecting growing confidence.

Technically, a key trendline has been breached, the analyst said. The stock should be watched only above ₹3,875, with ₹3,604 as a closing support, she added.

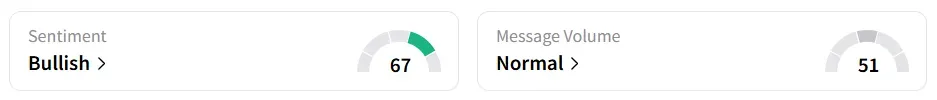

Retail sentiment was ‘bullish’ on Stocktwits, having been ‘bearish’ a week earlier.

CEAT shares are currently trading 1.75% higher at ₹3,853.5, having gained 19% YTD.

F&O Stockwatch

NTPC has broken out of a consolidation box, indicating potential upside momentum, the analyst said. Watch for a move above ₹345, with ₹329 as the key support on a closing basis, she added.

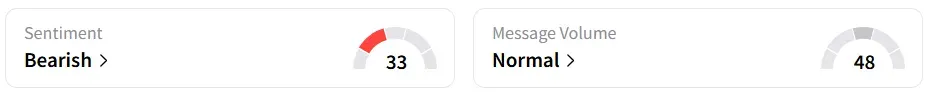

Retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a day ago.

NTPC shares were slightly up at ₹343.65 on Wednesday. It had added 3.3% to its value on a YTD basis.

DLF is showing signs of reversal from a strong support zone. A breakout above ₹850 could trigger further gains, with ₹819 seen as a crucial support level, Kumar said.

DLF shares were down 1.8% at ₹828.85 at the time of writing. YTD gains stood at 0.7%

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)