Advertisement|Remove ads.

GEMI Stock Soars On Nasdaq Debut – Joins Figure, Circle, Bullish In Crypto IPO Wave

Gemini Space Station (GEMI) shares surged in their Nasdaq debut on Friday, marking a strong start for the crypto exchange led by the Winklevoss twins, Tyler and Cameron.

Gemini’s stock was trading at around $40 at the time of writing, marking a jump of 45% from its IPO price of $28. That pricing topped the earlier $24 to $26 target range and was significantly higher than the initial $17 to $19 band announced at the beginning of September. Gemini raised approximately $425 million through the sale of 15.2 million shares, slightly less than the originally planned 16.7 million shares.

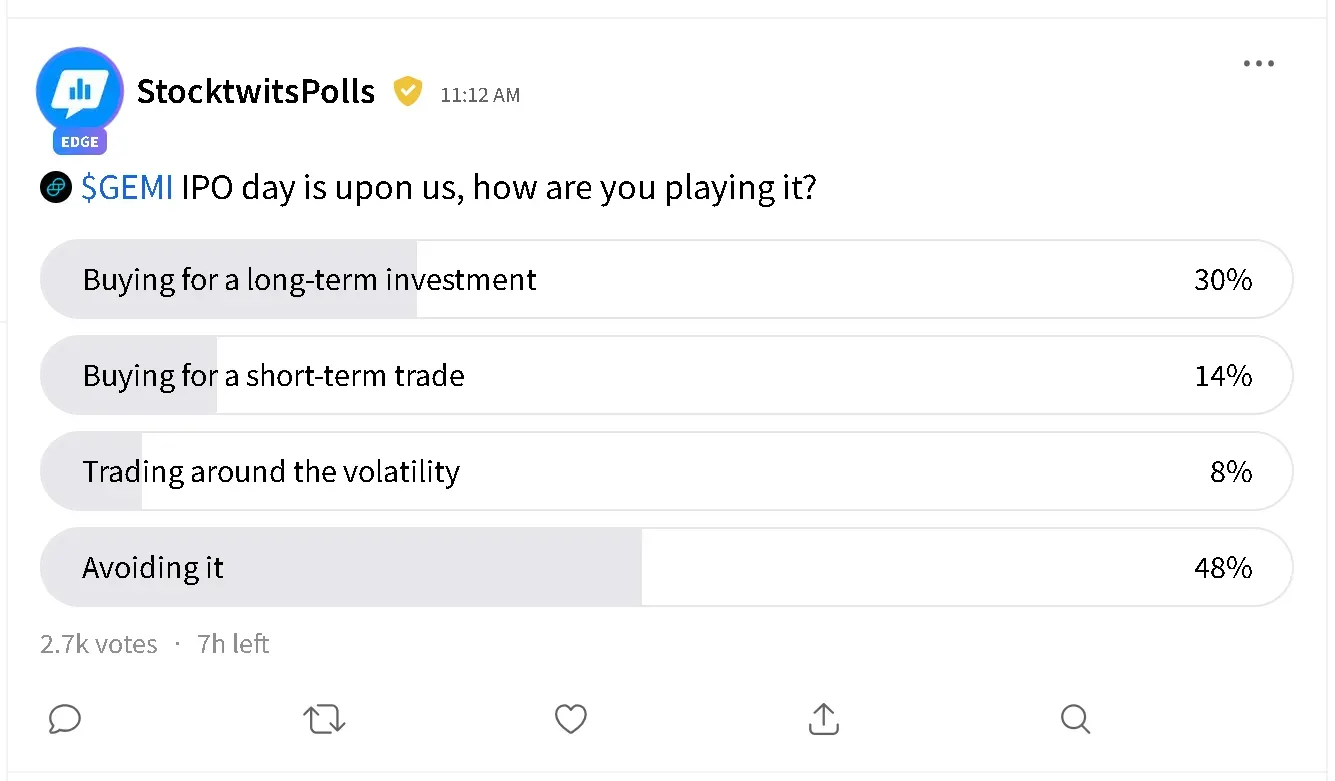

On Stocktwits, retail sentiment around GEMI’s stock rose to ‘extremely bullish’ from ‘bullish’ with retail chatter surging to ‘extremely high’ from ‘high’ levels over the past day. However, an ongoing poll on the platform reflected a more cautious stance. Nearly 50% of retail investors reported avoiding the IPO, while 30% planned to buy for the long term, 14% for a short-term trade, and 8% to capitalize on volatility.

The Winklevoss twins-backed exchange is seeking to ride renewed momentum in the IPO market for crypto firms. Circle Internet (CRCL) surged on its June debut, while Bullish (BLSH) notched solid gains after listing in August. Just a day before Gemini’s debut, blockchain lender Figure Technology Solutions (FIGR) climbed roughly 30% after pricing above its expected range.

Retail optimism for crypto-linked equities has also surged of late, driven by rising digital asset prices. Bitcoin (BTC) has been trending higher, along with Ethereum (ETH), Solana (SOL), Dogecoin (DOGE), and other major tokens. The regulatory stance in Washington has also improved under the Trump administration, with SEC Chair Paul Atkins taking a comparatively crypto-friendly approach, in contrast to his predecessors.

However, Gemini will have to compete against rivals in the public markets, including Coinbase (COIN), Robinhood Markets (HOOD), Galaxy Digital (GLXY), and Interactive Brokers (IBKR). Beyond the listed players, privately held giants such as Binance, Kraken, and eToro are also aggressively competing for both retail and institutional crypto brokerage market share.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)