Advertisement|Remove ads.

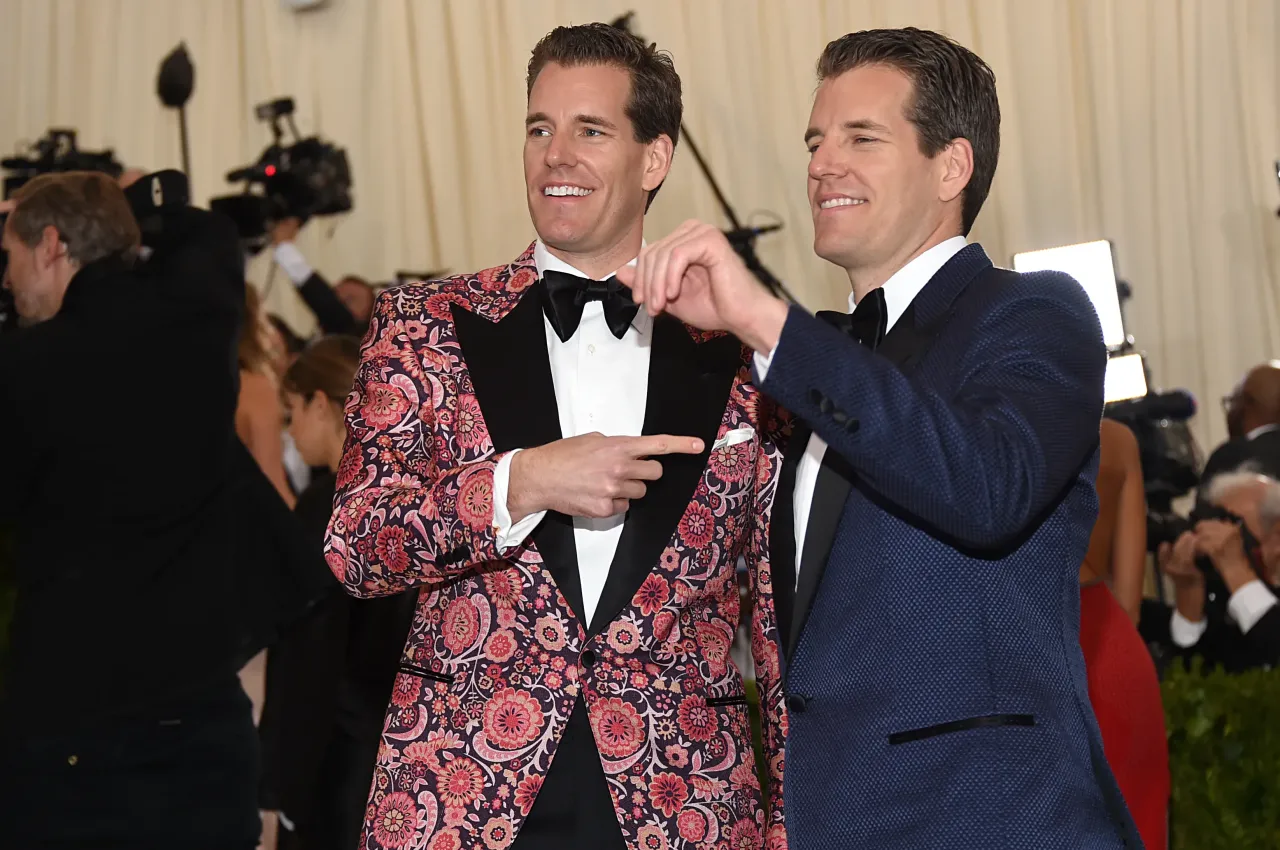

Winklevoss Twins’ Gemini Prices IPO At $28 As Retail Buzz Runs ‘Extremely Bullish’ Ahead Of Nasdaq Debut

The Winklevoss twins-backed crypto exchange Gemini (GEMI) priced its IPO at $28 per share, raising approximately $425 million and exceeding expectations ahead of its Nasdaq debut on Friday.

On Stocktwits, retail sentiment around Gemini’s stock was running hot ahead of the debut. The stock has already drawn more than 1,000 followers, with chatter at ‘extremely high’ levels and sentiment firmly in ‘extremely bullish’ territory.

The crypto exchange, founded by Tyler and Cameron Winklevoss, is set to begin trading under the ticker ‘GEMI’ on the Nasdaq Global Select Market. The pricing came in well above the original $17 to $19 range, reflecting strong investor demand for one of the year’s most closely watched crypto listings.

In an interview with CNBC on Friday, the Gemini co-founders stated that they knew they would conduct a Gemini IPO when the crypto exchange was launched nearly ten years ago. “I think the price of Bitcoin was around $380…. But we also think it’s very much the bottom on the first inning, because we see Bitcoin trading at $1 million if it disrupts gold,” they said.

The Winklevoss twins also expressed optimism around the regulatory environment in the U.S. becoming more crypto-friendly. “If you look at Project Crypto, that’s the SEC’s effort to bring markets on-chain. We recently partnered with Nasdaq to help power that future and bring markets on-chain. We think we’re just getting started,” they said.

Bitcoin’s price crossed $115,000 in morning trade on Friday, edging 0.8% higher in the last 24 hours. On Stocktwits, retail sentiment around the apex cryptocurrency moved higher but remained in ‘bearish’ territory.

Read also: Upexi Stock Pops Pre-Market, Retail Chatter Surges On Growing Solana Treasury Holdings

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)