Advertisement|Remove ads.

Geo Group, CoreCivic Stocks Rally Despite Mixed Earnings As Trump-Fueled Surge Keeps Retail Extremely Bullish

Shares of private prison operators Geo Group ($GEO) and CoreCivic ($CXW) spiked on Thursday, building on a previous rally triggered by Donald Trump’s presidential victory, which spurred strong optimism among retail investors.

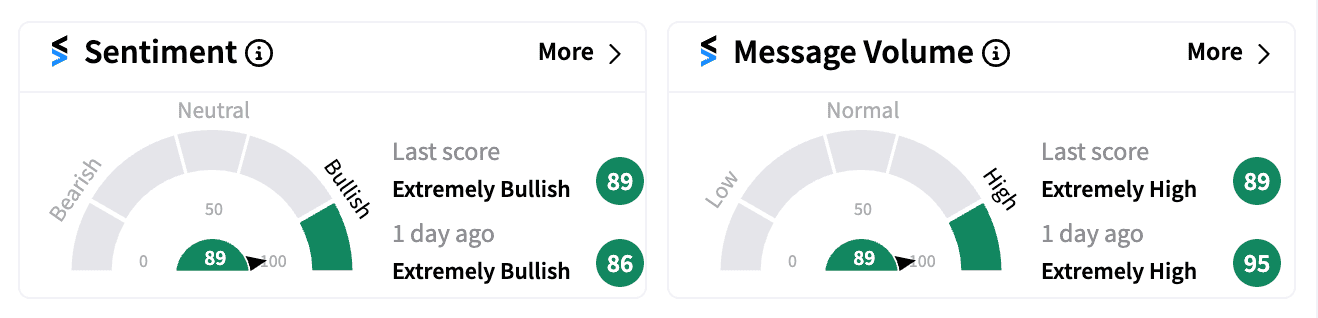

Despite reporting mixed third-quarter earnings, retail sentiment for both stocks remained supremely upbeat on Stocktwits.

Geo Group’s Q3 results came in below expectations, with adjusted EPS at $0.21 compared to the consensus estimate of $0.24, and revenue of $603.1 million, short of the $613.26 million forecast.

Geo Executive Chairman George Zoley attributed the miss to weaker-than-expected revenue in the company’s Electronic Monitoring and Supervision Services segment.

However, Zoley highlighted potential growth opportunities, noting that GEO has 18,000 available beds across facilities that could bolster financial performance if activated.

Looking ahead, GEO projects 2024 adjusted EPS in the range of $0.80 to $0.84 and revenue of $2.42 billion, both below analyst expectations.

Retail investors appeared unfazed by the earnings miss, focusing instead on policy implications.

One bullish Stocktwits user argued, “GEO is not an earnings-driven story; it is a policy-driven story,” pointing to potential favorable shifts under Trump’s administration.

CoreCivic, on the other hand, smashed expectations with Q3 adjusted EPS of $0.20 against a consensus of $0.09, alongside revenue of $491.6 million, surpassing the $469.83 million forecast.

CEO Damon Hininger cited stronger operating margins driven by increased occupancy rates, which rose to 75.2% from 72% a year ago, and highlighted CoreCivic’s robust balance sheet with net debt to adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) at 2.2x, below the company’s target range.

“As we look forward to opportunities in 2025 and beyond, CoreCivic is ready to respond quickly and flexibly to our governmental partner's needs due to our talented and experienced teams, healthy balance sheet and readily available and modern bed capacity,” he said.

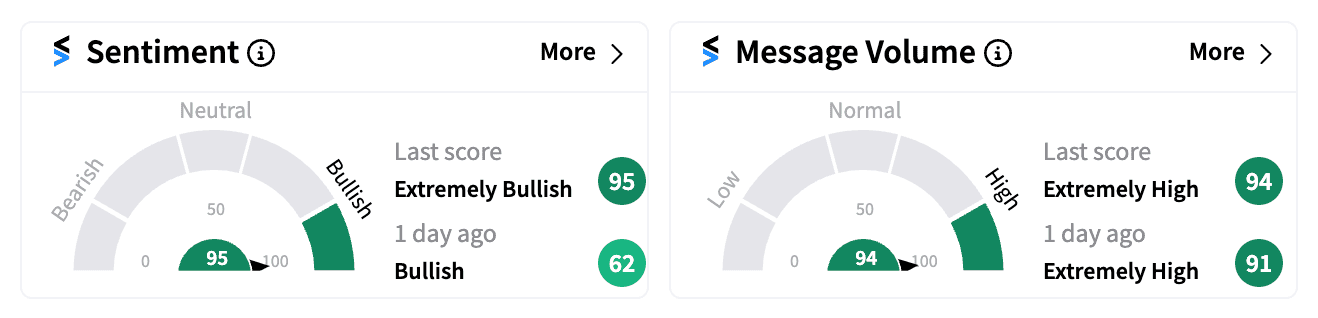

As with GEO, retail sentiment for CXW surged into the ‘extremely bullish’ zone on Stocktwits, with one user remarking, “GEO and CXW are the real Trump plays now” .

Trump’s vow to implement the largest mass deportation of undocumented immigrants in U.S. history has heightened investor confidence in private prison operators, which are likely to benefit from increased demand.

Year-to-date, GEO has gained 124%, while CXW is up over 50%

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2248926041_jpg_87d77606e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rare_Earth_resized_jpg_e635892f59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_bear_crash_93b71a2ed3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_global_e_online_jpg_d113293502.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2210782299_jpg_f1c47d74a6.webp)