Advertisement|Remove ads.

Gold Glitters In Run-up To 2024 Presidential Election: Here’s How Yellow Metal Fared In First Year Of Trump, Biden Tenures

Gold futures rose to a record on Wednesday as the uncertainty over the outcome of the 2024 presidential election continues.

The precious metal, however, came under some selling pressure in Thursday’s session amid the release of inflation data that casts a cloud on aggressive rate cuts by the Federal Reserve.

Notwithstanding the pullback, gold futures have soared nearly 35% for the year-to-date period, outperforming the 23% gain for the SPDR S&P 500 ETF Trust ($SPY), an exchange-traded fund that tracks the performance of the S&P 500 Index.

What’s Driving Gold Rally

The imminent U.S. election is seen as a key risk event that is driving the safe-haven gold higher. Nationwide opinion polls have all been unanimous in projecting a close election, with the lead in most cases coming within the margin of error of the survey.

The results of the Economist/YouGov survey released Wednesday showed Vice President Kamala Harris ahead of her rival Donald Trump by a point among registered voters and by two points among likely voters. This is well within the survey’s margin of error of +/- 3.4% for registered voters.

Saxo Bank Head Of Commodity Strategy Ole Hansen said in a post on Wednesday that rate cuts by the Fed and other central banks are reducing the cost of holding non-interest-bearing assets like gold and silver.

“The latest strength is increasingly being seen as a hedge against a potential ‘Red Sweep’ at the 5 November US election, where one political party, in this case, the Republicans, controls both the White House and Congress,” the strategist said.

This has pushed up bond yields amid concerns about excessive government spending, likely pushing up the debt-to-GDP ratio higher, and potential reignition of inflationary pressure through tariffs on imports, Hansen said.

Following Thursday’s hotter-than-expected inflation data, gold bull and economist Peter Schiff said instead of selling gold in the wake of the data, investors should be buying it. “Inflation will get a lot hotter than this but the Fed will not take action to fight it. This is extremely bullish for gold,” he said.

Against the backdrop, here’s a look at how gold performed in the first year of the presidency of the Republican Trump in 2017 and that of Democrat Joe Biden in 2021.

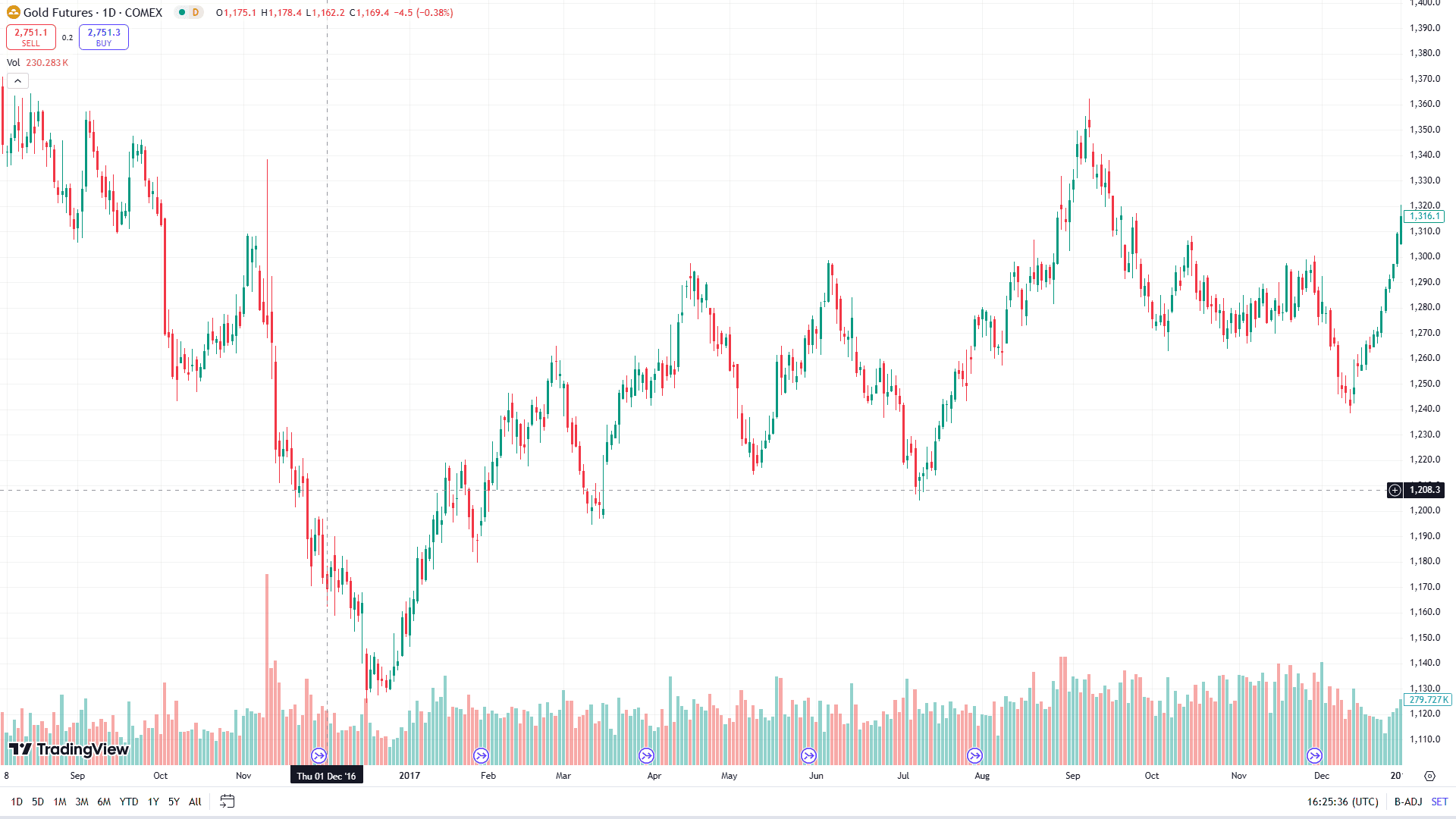

Gold Under Trump

Gold futures finished higher during the first year of Trump's presidency. The yellow metal had pulled back sharply ahead of the Nov. 8, 2016 election and barring a sharp spike a day after the election, it declined through mid-Dec. 2016.

In 2017, gold saw intermittent rallies and pullbacks. Peaking above the $1,360 level in mid-September, it gave back some of its gains and yet finished the year about 14% higher.

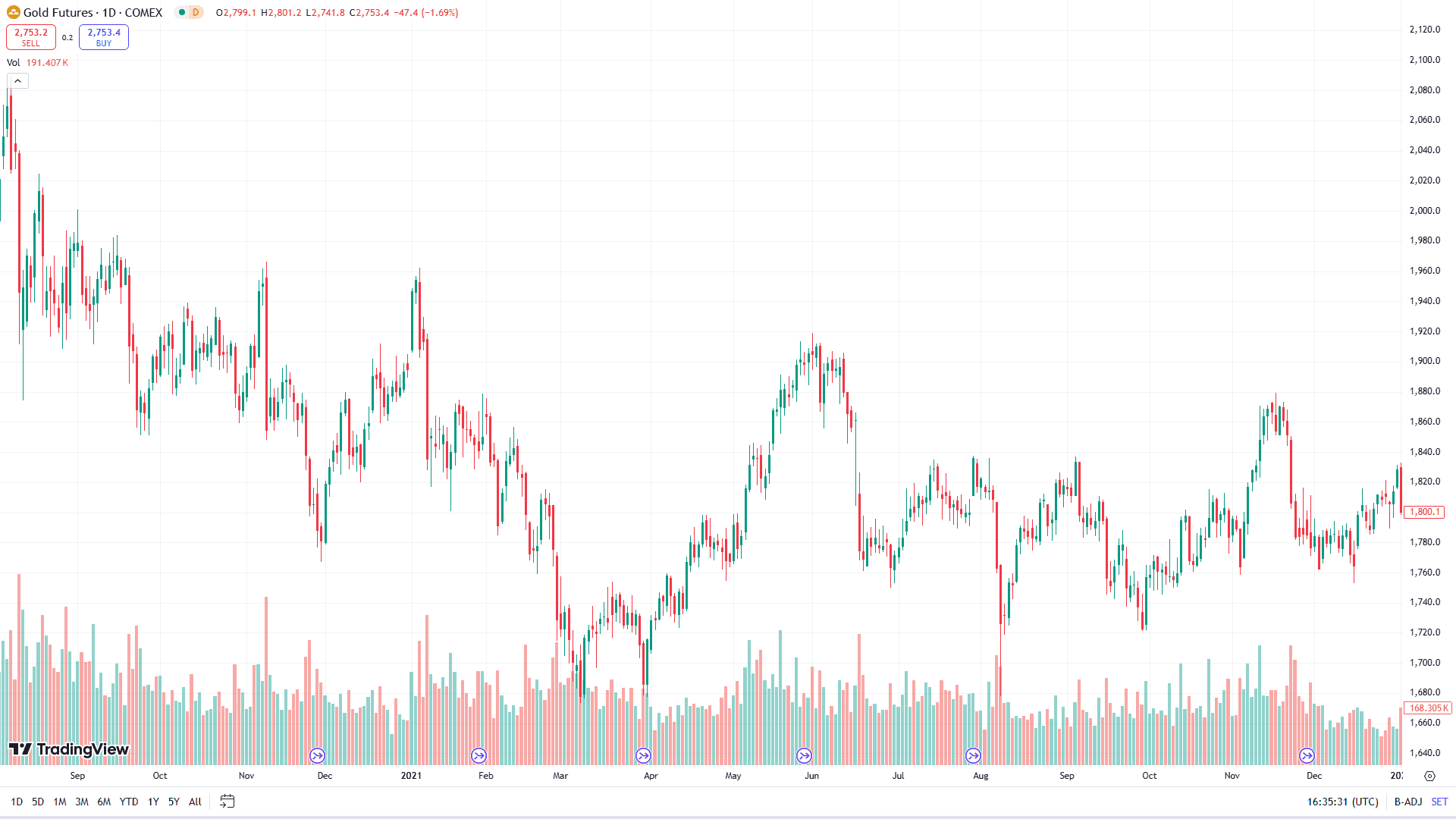

Gold Under Biden

When Biden emerged victorious in the election held on Nov. 3, 2020, gold did not have as good a run as under his predecessor. It was a broader downtrend ahead of the election and the continuation of the trend until March 2021.

Although the yellow metal staged a recovery, the rally proved short-lived. Gold futures peaked in early June before pulling back. Subsequently, it was locked in a broader consolidation phase.

Gold ended 2021 down about 3.6%.

The comparisons may not always be apples-to-apples as the two past presidents have had to contend with entirely different sets of conditions and challenges during their times at office. Biden took over from Trump an economy that was limping back to normalcy after a pandemic that impacted consumers, businesses and economies world over.

As of 1:24 pm, the SPDR Gold Shares ($GLD) fell 1.66% to $253.22.

A few in the retail crowd recommended buying the precious metals, citing imminent economic and geopolitical risks.

Others see gold spiking at least until the election and expect it to get a further boost from Fed rate cuts.

Read Next: TMTG, CoreCivic, Humana Stocks Poised For Gains With Trump Victory: Retail Sentiment Mixed

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_hut8_OG_jpg_66d77fe261.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_klarna_OG_jpg_830d4c6bf5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)