Advertisement|Remove ads.

Hallador Energy Falls After Q4 Revenue Miss, Retail’s Upbeat About Long-term Prospects

Hallador Energy (HNRG) stock fell 4.5% in extended trade on Monday after the company’s fourth-quarter revenue missed Wall Street’s estimates.

The coal producer posted a quarterly revenue of $94.2 million for the three months ended Dec. 31, compared with analysts’ estimate of $95.5 million, according to FinChat data.

Hallador said its electricity sales were $69.7 million during the reported quarter compared to $37.1 million a year earlier.

The Terra Haute, Indiana-based company said its coal sales fell to $23.4 million from $81.3 million in the year-ago quarter.

During 2024, the company slashed its coal production volume by about 40% and shifted its focus away from the higher-cost portions of its coal reserves.

Hallador realized an approximately $215 million non-cash write-down in the fourth quarter related to the carrying value of its Sunrise Coal unit.

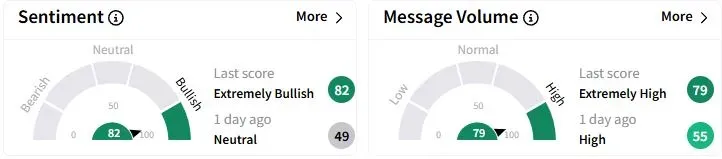

Yet, retail sentiment on Stocktwits jumped to ‘extremely bullish’ (82/100) territory from ‘neutral’(49/100) a day ago, while retail chatter rose to ‘extremely high.’

One retail user hoped the company’s data center deal would lift the stock to $15 in the coming weeks.

Hallador had signed an exclusive commitment agreement with a global data center developer in January.

“We are making meaningful progress toward finalizing definitive agreements for this transaction within the exclusivity period that runs from January through early June 2025, further strengthened by our partner’s commitment to pay up to $5 million during this period,” CEO Brent Bilsland said.

Another user was enthused by a post by Donald Trump on Truth Social, where the U.S. President said he would authorize his administration to boost electricity production from coal to combat China’s economic advantage from using the fossil fuel.

Over the past year, Hallador stock has gained 76.6%.

Also See: Finvolution Stock Rises After-Hours On Dividend Hike, Share Buyback Plan: Retail’s Ecstatic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)