Advertisement|Remove ads.

Here’s What Federal Reserve Governor Adriana Kugler Said On The Central Bank’s Dual Mandate

Federal Reserve Governor Adriana Kugler said it is important to pay attention to both sides of the central bank’s mandate given the gradual move towards the regulator’s inflation target and cooling labor markets.

“This combination of a continued but slowing trend in disinflation and cooling labor markets means that we need to continue paying attention to both sides of our mandate,” she said at the Albert Hirschman Lecture in Uruguay.

“If any risks arise that stall progress or reaccelerate inflation, it would be appropriate to pause our policy rate cuts. But if the labor market slows down suddenly, it would be appropriate to continue to gradually reduce the policy rate,” she said.

The central bank recently reduced the Fed funds rate by 25 basis points after a larger-than-expected 50 basis points cut in September when the policy easing cycle commenced.

Kugler also pointed out that while wage moderation and anchored inflation expectations may allow progress on inflation, stubborn housing inflation and high inflation in certain goods and services categories may stall progress in reaching the Fed’s target.

“At the same time, labor markets have rebalanced, given greater labor supply from immigration and prime-age workers and lower demand from restrictive monetary policy,” she said.

U.S. consumer inflation witnessed an uptick in October but still remained in line with Wall Street estimates. According to the Bureau of Labor Statistics, the consumer price index (CPI) increased 0.2% on a seasonally adjusted basis in October, recording the same increase as in each of the previous three months.

The 12-month inflation rate rose 2.6%, 0.2 percentage points higher than September, partly due to the base effect, i.e. lower inflation a year ago. Meanwhile, core CPI, which excludes food and energy, rose 0.3% in October and gained 3.3% for the 12-month period.

Meanwhile, wholesale prices also rose in line with expectations with the producers price index rising a seasonally adjusted 0.2% for the month. On a 12-month basis, headline wholesale inflation stood at 2.4%.

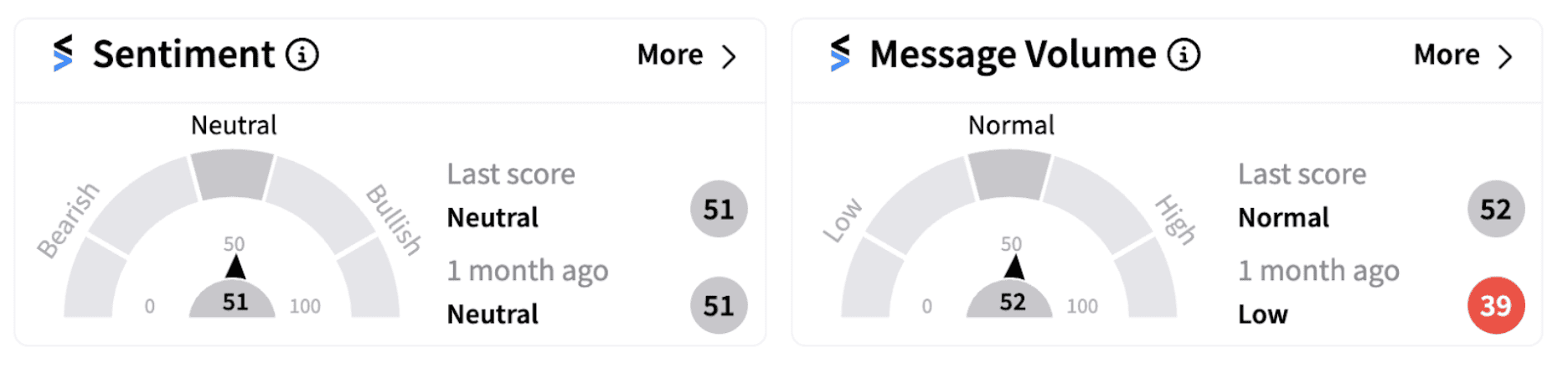

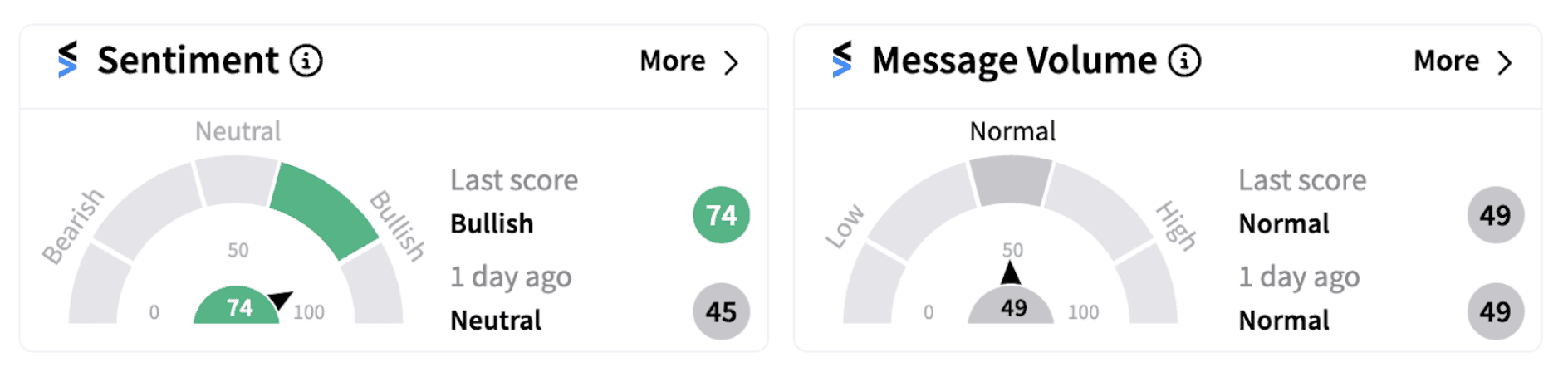

Following the release of the data, the SPDR S&P 500 ETF Trust ($SPY) was trading marginally in the green while the Invesco QQQ Trust, Series 1 ($QQQ) was trading in the red on Thursday morning. However, retail sentiment on Stocktwits remained divergent for both the ETFs.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137832_jpg_1de3e68131.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)