Advertisement|Remove ads.

UiPath Issues Subpar Guidance Citing Macro Uncertainty After Mixed Q4: Stock Set To Hit Record Low But Retail’s Upbeat

UiPath, Inc. (PATH) shares plunged in Thursday’s premarket after the enterprise automation and artificial intelligence (AI) software company announced a quarterly earnings beat, but revenue and the forward guidance disappointed.

The New York-based company reported adjusted earnings per share (EPS) of $0.26 and revenue of $424 million for the fourth quarter of the fiscal year 2025. The year-over-year (YoY) top-line growth slowed to 5% from the 9% growth witnessed in the third quarter

The Finchat-compiled consensus called for adjusted EPS and revenue of $0.19 and $425.34 million, while UiPath’s guidance issued in early December estimated revenue of $422 million to $427 million.

The annualized renewal run-rate (ARR) was $1.666 billion as of Jan. 31, up 14% compared to the 17% growth in the previous quarter. The metric came in at the low-end of the $1.669 billion to $1.674 billion guidance. The net new ARR was $60 million.

The dollar-based net retention rate was 110%, less than the third quarter’s 113%.

The adjusted gross margin expanded to 87% from 85% in the third quarter.

UiPath’s adjusted free cash flow was $145 million, and its cash position at the end of the quarter was $1.7 billion.

CEO Daniel Dines said, “I am happy with the progress we made over the last several quarters, stabilizing our go-to-market organization, reinvigorating our commitment to customer-centricity, accelerating innovation, and deepening our relationships with strategic partners.”

CFO Ashim Gupta noted that the company achieved a record adjusted operating margin and strong adjusted free cash flow generation.

The company guided first-quarter revenue in the range of $330 million to $335 million and end-of-the-quarter ARR in the range of $1.686 billion to $1.691 billion.

For the fiscal year 2026, UiPath expects revenue of $1.525 billion to $1.530 billion and end-of-the-year ARR of $1.816 billion to $1.821 billion.

Analysts, on average, estimate revenue of $364.89 million for the quarter and $1.582 billion for the year.

Gupta said the guidance reflected the increasing global macroeconomic uncertainty, particularly in the U.S. public sector, over the last several weeks.

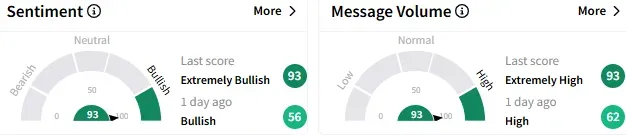

On Stocktwits, retail sentiment toward UiPath stock has turned to ‘extremely bullish’ (93/100) from ‘bullish’ a day ago, and the message volume perked up to ‘extremely high’ levels.

A bullish watcher said they were optimistic because of the company’s revenue, cash on hand, and nil debt position.

Another user said the post-earnings pullback presents a rare opportunity to buy the stock under $10

UiPath's stock slumped 17.67% in premarket trading to $9.74, heading toward a record low. If the premarket losses are sustained on Thursday, the stock is on track to record its biggest one-day loss since May 29, 2025, according to Koyfin.

The stock has lost about 7% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)