Advertisement|Remove ads.

Janux Therapeutics Stock Sinks 50% After Prostate Cancer Trial Triggers Target Cuts Across Wall Street — Retail Sees A FOMO-Fueled Rebound

- Analysts flagged missing timelines and lingering questions in the JANX007 Phase 1 update.

- Several firms also kept bullish ratings, calling the sell-off disproportionate.

- Retail traders on Stocktwits pointed to low float dynamics and average targets far above current levels.

Shares of Janux Therapeutics (JANX) fell nearly 50% on Tuesday after several analysts lowered their price targets following the company’s updated Phase 1 interim results for JANX007, its experimental prostate cancer drug currently being tested in patients with metastatic castration-resistant prostate cancer (mCRPC).

Janux reported durable responses, a radiographic progression-free survival (rPFS) of 7.9–8.9 months, deep declines in prostate-specific antigen (PSA), and a manageable safety profile for cytokine release syndrome (CRS), a common immune-related side effect. Early-stage results in patients who had not previously received taxane chemotherapy were also described as “encouraging.”

While the company called the update positive, analysts said the dataset raised concerns that contributed to the stock’s steep fall.

Missing Timelines And Unanswered Questions

Cantor Fitzgerald analyst Josh Schimmer cut his price target to $150 from $200 while keeping an ‘Overweight’ rating. Schimmer said the new data answered some important questions but still left “a handful of remaining variables and blanks to fill in.” He noted that Janux did not provide timelines for when investors can expect the next clinical update or regulatory milestone.

Mixed Efficacy Signals

H.C. Wainwright reduced its price target to $45 from $70 and maintained a ‘Buy’ rating. The firm said the drug’s overall effectiveness weakened on certain key measures, describing the data as “mixed.” It added that JANX007 will likely be a “show me” story, meaning investors will wait for more mature, clearer results before regaining confidence.

Bank of America Securities (BofA) also called the update “admittedly mixed,” while cutting its target to $49 from $58 and keeping a ‘Buy’ rating.

The firm said JANX007 is still “a viable drug with a reasonable safety profile” and may eventually show an improvement in overall survival (OS) compared with Novartis’s Pluvicto, another prostate cancer therapy. However, BofA has now pushed its expected launch to 2028 and lowered its predicted peak market share to 15% from 20%.

Stifel analyst Stephen Willey echoed the mixed tone, saying there were “some positives to extract” but also ongoing questions about the dataset. He lowered his price target to $38 from $46 while keeping a ‘Buy’ rating and said the near-term catalyst calendar doesn’t set up great. Even so, Willey said he “struggles to rationalize” the drop in the stock.

Stock Slide Viewed As Excessive

Bank of America said the stock’s decline appears “overdone,” even after adopting more cautious assumptions. Cantor Fitzgerald also said the selloff looks overdone and called the current valuation “a compelling entry point.”

Clear Street lowered its price target to $32 from $80 while maintaining a ‘Buy’ rating. The firm said its cut reflects a "more pragmatic" market entry timeline and said the updated data show a “thoughtful development process.”

Stocktwits Traders Brace For A Sharp Rebound Rally

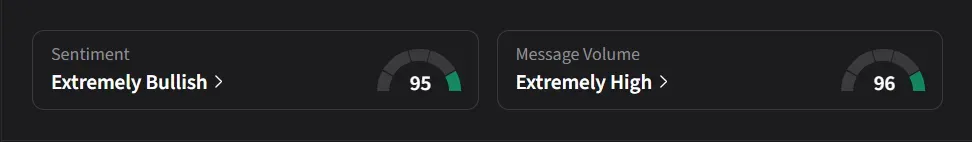

On Stocktwits, retail sentiment for Janux was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “the FOMO is going to hit hard with the sideliners watching when the rebound rally kicks off.”

Another bullish trader suggested the stock sits in a retail-driven sweet spot, highlighting the low float, small-cap setup, the “massive discount,” and average targets in the $70–$77 range. They also argued the drop was a “clear overreaction.”

Janux’s stock has declined 67% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)