Advertisement|Remove ads.

Jensen Huang Thinks We’ll All Run Our Own Mini Nuclear Reactors In Our Backyards — What Today’s AI Power Crunch Really Looks Like

- The power need of data centers, which are relatively new actors in the energy system, is widely expected to grow exponentially.

- U.S. residential retail electricity prices in September were up 7.4% year over year to about 18 cents per kilowatt-hour, underscoring the strain on the grid.

- Wedbush’s Daniel Ives sees the demand for new energy to power the AI revolution exploding in the coming years.

Nvidia CEO Jensen Huang’s “Joe Rogan Experience” podcast appearance caught a few off guard, given that he typically shows up at more formal setups rather than a long-form, freewheeling show. As expected, the conversation veered around all things artificial intelligence (AI).

The head honcho of the most valued publicly listed company also touched on a hot-button topic: power-hungry data centers. Calling that issue “the bottleneck” for AI, Huang said, “I think in the next six, seven years, I think you’re going to see a whole bunch of small nuclear reactors.”

“We’ll all be power generators,” he said, suggesting hyperscalers might be mulling captive power sources in the future. “It probably is the smartest way to do it. Right. And it takes the burden off… the grid. It takes — and you could build as much as you need, and you can contribute back to the grid.”

In a lighthearted show, this could be one of the most loaded statements, underlining the importance of energy to power data centers that run a massive infrastructure of servers, storage drives, and network equipment to train models, inference, and run critical applications and services.

Data Center Draining Grid?

The AI revolution is here to stay despite all talk of a bubble burst. The power need of data centers, which are relatively new actors in the energy system, is widely expected to grow exponentially.

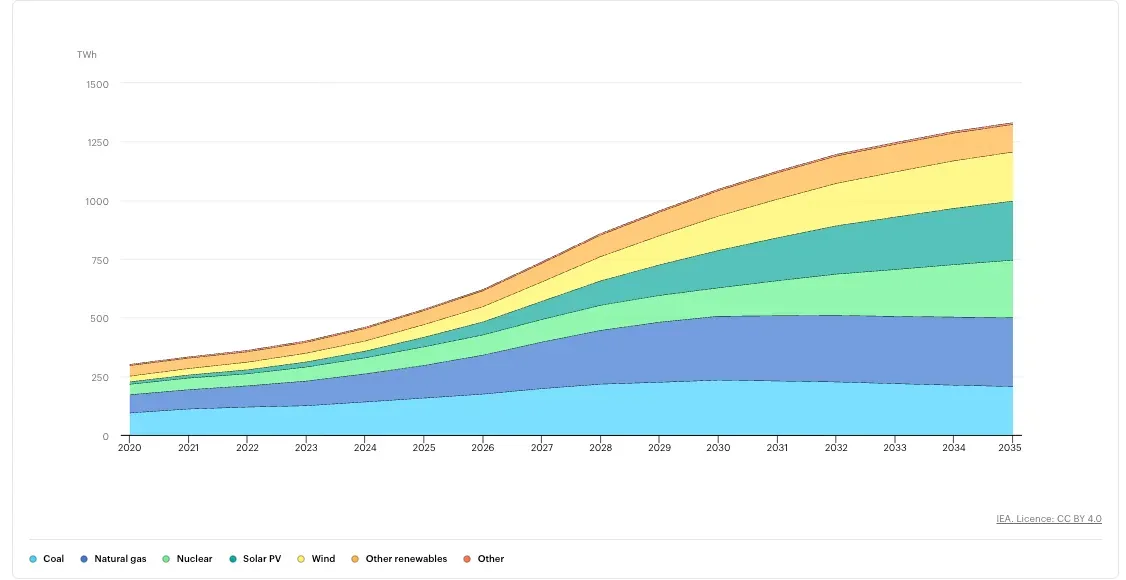

According to the International Energy Agency’s estimates, global electricity consumption by data centers is currently at about 415 terawatt-hours (TWh). That is expected to more than double, reaching around 945 TWh by 2030 in the base-case scenario, representing nearly 3% of total global electricity consumption. The IEA states that training the largest large-language model (LLM) requires about 154 megawatts (MW) of power.

Goldman Sachs estimates that global power demand from data centers will rise 50% by 2027 and as much as 165% by the end of the decade, from the level seen in 2023. Due to higher processing workloads driven by AI, power density in data centers will increase to 176 kilowatts (KW) per square foot in 2027, up from 162 kW in 2023.

The U.S. and China are currently the largest data center markets. The Trump administration has made no bones about its data center thrust to maintain pole position in the AI race. Last week, President Donald Trump signed an executive order establishing the “Genesis Mission,” a new endeavor to expand AI resources for scientific research. He is also considering an executive order to block state AI laws, signaling his intent to bring AI under the federal framework.

In the U.S., natural gas (over 40%) is currently the most significant source of electricity for data centres, followed by renewables, primarily solar photovoltaic cells and wind (24%). Nuclear and coal power have shares of around 20% and 15%, respectively.

Source: IEA

Data center needs have been a bane for consumers. Residential retail electricity prices in September were up 7.4% year over year, to about 18 cents per kilowatt hour, according to the Energy Information Administration (EIA). A May EIA report showed that electricity prices will likely outpace inflation at least through 2026, after tracking in line with inflation from 2013 to 2023.

Huang Sparks Fresh Nuclear Hype

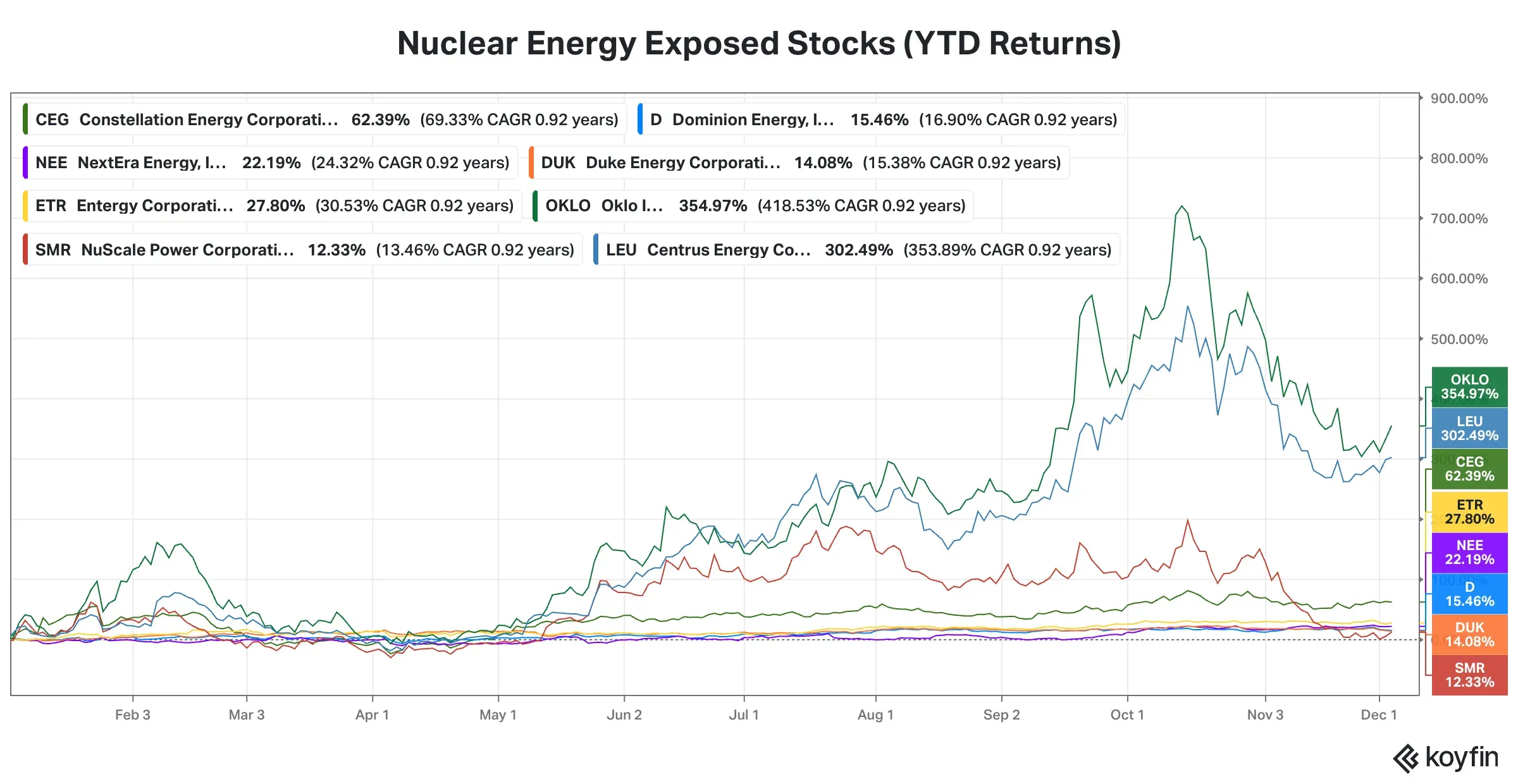

The Nvidia CEO comments bring the spotlight to nuclear energy stocks, both big and small. Among legacy utility companies, Constellation Energy (CEG), NextEra Energy (NEE), Entergy (ETR), Duke Energy (DUK) and Dominion Energy (D) are considered nuclear energy plays. Smaller players such as Oklo (OKLO) and NuScale Power (SMR) are also making all the right noises.

Adjacent players such as Centrus Energy (LEU), which provides nuclear fuel and enrichment services, are also well positioned to capture a slice of this accelerating boom.

Here’s how shares of these companies fared this year.

Source: Koyfin

Source: Koyfin

Most of these stocks have generated returns that align with or exceed the broader market, with some of the upside also driven by their defensive appeal amid an uncertain economic environment.

Wedbush analyst Daniel Ives sees Oklo stock rising to $150 from sub-$100 levels, premised on his expectation that demand for new energy to power the AI revolution will explode in the coming years.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)