Advertisement|Remove ads.

JPMorgan Backs Apple Amid Trump Tariff Warning: Retail Sentiment Brightens

JPMorgan stands firm on its bullish stance on Apple Inc. (AAPL), maintaining an ‘Overweight’ rating despite renewed trade tensions.

This comes in response to a statement made by U.S. President Donald Trump, who signaled a potential 25% tariff on Apple if iPhones sold in the United States are not manufactured within the country.

According to TheFly, JPMorgan stated that such duties would likely target all smartphones, not just iPhones, giving Apple a comparative advantage in the market.

According to the firm, Apple’s significant leverage with consumers and its supply chain could help the tech giant weather the impact better than its competitors.

JPMorgan also opined that the company could offset these added costs by modestly adjusting iPhone prices worldwide, potentially around a 5% uptick or roughly $50 per device.

This pricing shift, the brokerage argued, is within the range of past adjustments made by Apple.

JPMorgan further noted that relocating production to the U.S. isn’t a practical solution in the short term due to logistical challenges.

Instead, it expects Apple to tolerate the tariff costs temporarily, passing them along to consumers as it awaits more consistent policy direction from Washington.

Amid rising geopolitical strains between the U.S. and China, Apple has been shifting parts of its manufacturing operations to India to reduce risks linked to pricing and supply chain disruptions.

Consequently, the iPhone maker’s supplier, Hon Hai Precision Industry Co., aka Foxconn, has increased investment in its Indian subsidiary.

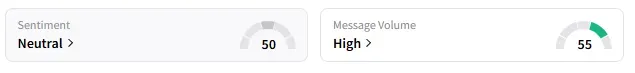

On Stocktwits, retail sentiment around Apple stock changed to ‘neutral’ from ‘bearish’ the previous day.

A Stocktwits user said the stock may be in a lot of trouble.

Another watcher asked an Apple representative to address the issue.

Apple stock has lost over 21% year-to-date and has gained 4.8% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)