Advertisement|Remove ads.

Kalshi CEO Says Super Bowl Trading Volumes Soared 2,700% This Year, Crossing $1B: Report

- Kalshi CEO Tarek Mansour also played down criticism of the company over concerns of insider trading.

- He added that, as a regulated financial market overseen by the Commodity Futures Trading Commission, Kalshi must follow the same rules as the Nasdaq and the New York Stock Exchange.

- Mansour also said that Kalshi has the same enforcement mechanism as the Nasdaq and the NYSE.

Kalshi CEO Tarek Mansour reportedly said on Tuesday that Super Bowl trading volumes on the platform soared 2,700% this year and crossed $1 billion.

During an interview with CNBC, Mansour stated that halftime performer Bad Bunny’s opening song crossed the $100 million mark in terms of trading volumes on the platform.

“It was an incredible weekend. Kalshi was the biggest brand of the Super Bowl this year, without running a Super Bowl ad, and the way we achieved that is the product,” Mansour said.

Kalshi is a regulated exchange and prediction market that allows users to trade on the outcomes of real-world events. Some examples include the Federal Reserve’s rate cuts, the race for the central bank’s Chair position, and the U.S. government shutdown.

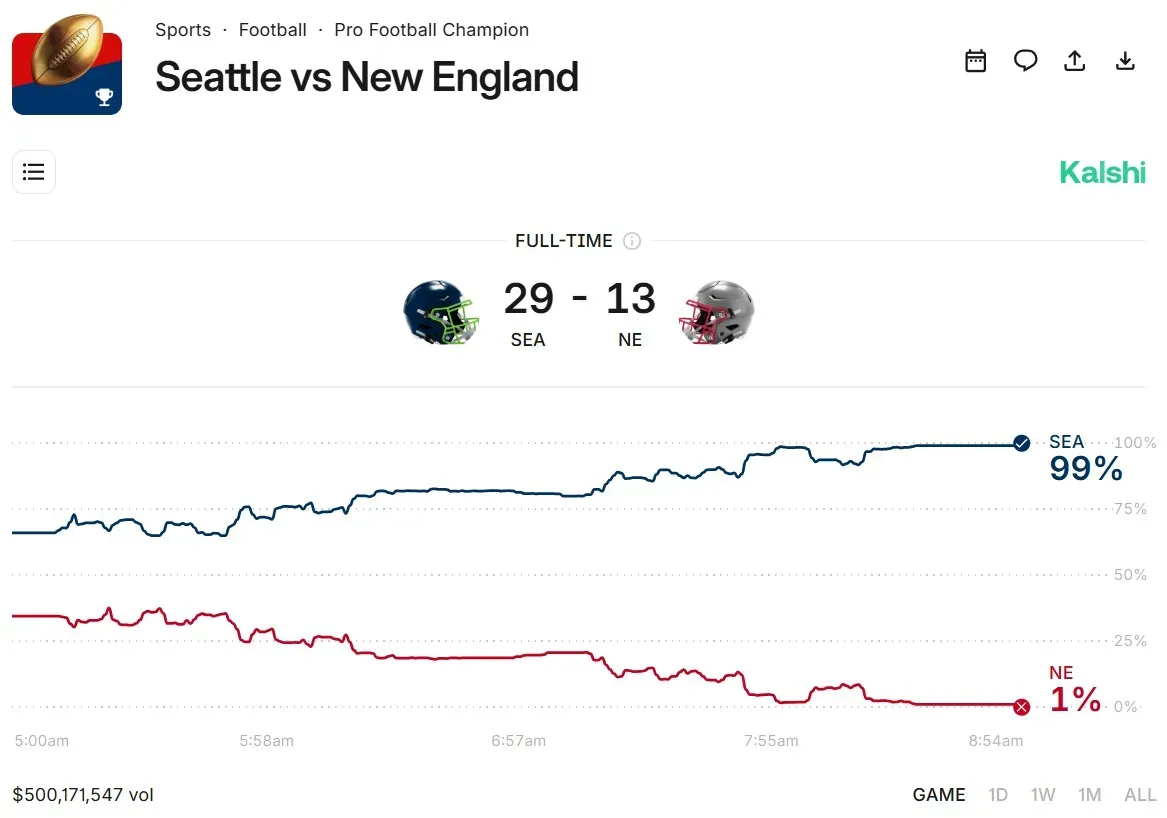

The Seattle versus New England game alone saw trading volumes of $500 million.

Mansour Plays Down Criticism

The Kalshi chief also played down criticism of the company over concerns of insider trading.

“The insider trading risk is very real for the stock market as well,” Mansour said in the interview.

He added that, as a regulated financial market overseen by the Commodity Futures Trading Commission (CFTC), Kalshi must follow the same rules as the Nasdaq and the New York Stock Exchange. Mansour also said that Kalshi has the same enforcement mechanism as the Nasdaq and the NYSE.

Kalshi’s Expanded Surveillance Efforts

The predictions platform announced expanded surveillance efforts a week before this year’s Super Bowl.

Kalshi formed an independent surveillance advisory committee and new trading surveillance partnerships with Solidus Labs and Daniel Taylor, Director of the Wharton Forensic Analytics Lab.

“Kalshi was the first to regulate prediction markets in America. We’re now bringing on some of the industry’s leading surveillance experts to build and guide the future of prediction market compliance,” said Kalshi’s Head of Enforcement, Robert DeNault.

Also See: Paramount Skydance Enhances $30 Per Share Bid For Warner Bros Discovery

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Dimon_July_b5bbf1a09d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)