Advertisement|Remove ads.

Katapult Stock Jumps Over 30% After Merger Agreement With Aaron’s And CCF – Why This Combination Makes Sense

- Under the agreement, current Katapult shareholders will own 6% of the combined company, with Aaron’s and CCF Holdings stakeholders holding the remaining 94%.

- The combined company will operate around 3,000 retail touchpoints and serve over seven million customers.

- KPLT stock surged more than 30% in premarket trading on Friday.

Katapult Holdings Inc. (KPLT) stock skyrocketed on Friday after the company entered into an all-stock merger agreement with The Aaron’s Company and CCF Holdings.

The combined company is projected to generate over $4 billion in LTM (last twelve months) revenue as of the third quarter, and around $450 million in earnings before interest, tax, depreciation, and amortization (EBITDA), with potential for long-term double-digit margins.

The stock surged 32% in premarket trading on Friday, with KLPT among the top trending tickers on Stocktwits.

Details Of The Deal

Under the agreement, current Katapult shareholders will own 6% of the combined company, with Aaron’s and CCF Holdings stakeholders holding the remaining 94%. Katapult will continue trading on the NASDAQ under the current ticker. The transaction is expected to close in the first half of 2026.

After the merger, the company will retain the Katapult Holdings name, and Cory Miller, the current CEO of Aaron’s, will serve as the combined company's chief executive. Aaron’s CFO, Russell Falkenstein, will take over as the head of finance. The combined company’s Board will feature nine directors.

The merger will combine Katapult’s technology with Aaron’s retail footprint and CCF Holdings’ customer base. The combined company will operate around 3,000 retail touchpoints, serve over 7 million customers, benefit from a diverse set of recurring revenue streams, and achieve better unit economics.

Aaron’s is an omnichannel retailer offering lease-to-own and direct-purchase solutions for furniture, electronics, and home goods. CCF provides alternative financial services to unbanked and underbanked customers.

How Did Stocktwits Users React?

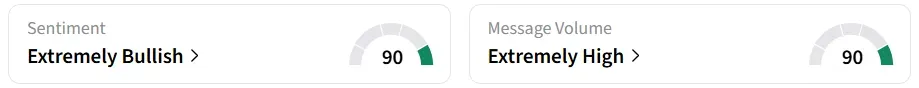

Retail sentiment on Stocktwits flipped completely to ‘extremely bullish’ from ‘extremely bearish’ a day earlier, accompanied by ‘extremely high’ message volumes.

Year-to-date, the stock has declined by over 8%.

Also See: Has Roblox’s Viral Growth Faded? JPMorgan Sees Rough Waters Ahead

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)