Advertisement|Remove ads.

Marvell Technology Stock Surges Ahead Of Q4 Results: Retail Strikes A Bullish Note As Nvidia’s Strong Performance Boosts Investor Confidence

Shares of Marvell Technology Inc. (MRVL) surged on Tuesday ahead of the semiconductor company’s fourth-quarter results.

Wall Street expects Marvell to post earnings per share (EPS) of $0.59 in Q4, surging from $0.46 in the year-ago period. Its revenue is expected to rise to $1.8 billion, up from $1.43 billion a year earlier.

The Santa Clara, California-headquartered company makes data processing units (DPU) and custom chips. Founded in 1995, Marvell has been on an acquisition spree over the past few years as it looks to expand its portfolio.

Despite semiconductor stocks being under the pump since the launch of DeepSeek in January, retail investors on Stocktwits were buzzing about Marvell’s prospects over the past week.

This is partly due to AI bellwether Nvidia Corp.’s blowout Q4 performance, giving investors confidence that data center demand is strong, which bodes well for companies like Marvell.

Data shows Marvell has missed earnings expectations in one out of the past four quarters, but it surpassed revenue estimates in all of them.

According to The Fly, analysts at Melius initiated coverage of Marvell with a ‘Buy’ rating. They said that the company “can get really big on AI” and assigned the stock a price target of $158.

Overall, FinChat data shows Marvell has an average price target of $129.56, implying an upside of nearly 47%.

Of the 39 brokerage recommendations, 26 have a ‘Buy’ rating, nine have an ‘Outperform’ rating, three say ‘Hold,’ while one brokerage has ‘No opinion.’

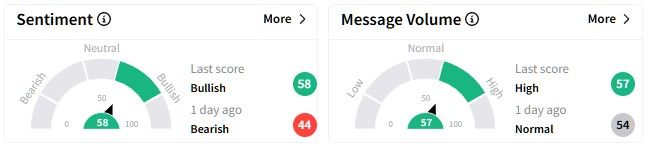

Retail sentiment on Stocktwits showed a rise in optimism among investors regarding the Marvell stock—it entered the ‘bullish’ (58/100) territory after straying into the ‘bearish’ zone a day ago.

Message volume picked up, too.

One user thinks Marvell is set to surge in the future and that they feel “comfortable” buying the dip.

Marvell’s stock has surged over 26% in the past six months, but its one-year performance is relatively less impressive, with gains of a little more than 12%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)