Advertisement|Remove ads.

Kotak Bank Cracks Key Support: SEBI RAs See Downside Amid Asset Quality Woes

Kotak Mahindra Bank shares plummeted over 7% on Monday, after it reported muted first-quarter results. This marked the third straight session of losses.

Standalone net profit stood at ₹3,282 crore in Q1 FY26, down 7% year-on-year after adjusting for a one-time gain from its insurance unit sale. Unadjusted profit stood at ₹6,250 crore for the June quarter (Q1 FY26).

The bottom-line decline was primarily due to a 109% increase in provisions to ₹1,208 crore. Net interest income increased by 6% to ₹7,259 crore, with the net interest margin remaining stable at 4.65%. Asset quality weakened, with gross NPA rising to 1.48% and net NPA at 0.34%.

On the technical charts, Kotak Mahindra Bank has broken down sharply, trading well below the crucial support level of ₹2,047, noted SEBI-registered analyst Harika Enjamuri.

At the time of writing, Kotak Mahindra Bank shares were down 7.2% at ₹1,969.40.

The breakdown came on strong volumes and a large bearish candle on both daily and weekly charts, signaling a shift in sentiment, the analyst added.

The stock now trades below 9-day, 70-day and 100-day moving averages, all of which are turning lower, suggesting the short- to medium-term trend has reversed.

Daily relative strength index (RSI) is oversold at 27.5, hinting at short-term exhaustion, but weekly RSI suggests further downside, Enjamuri said.

Key support levels are at ₹1,846 and ₹1,722, while ₹2,047 now acts as stiff resistance. Unless reclaimed quickly, the broader trend remains negative, she said.

SEBI RA A&Y Research added that the stock confirmed a bearish breakdown by trading below the crucial ₹2,055–2,037 support zone on strong volume.

With sellers firmly in control, the next key support is seen at ₹1,916 - ₹1,940, a historical support zone, they added. Until the stock reclaims former support levels, the technical outlook remains bearish.

Fundamentally, asset quality showed signs of stress. The bank reported higher credit costs, particularly in its microfinance and commercial vehicle (CV) loan segments, which adds to near-term concerns. However, despite the muted results, business growth has been steady with advances rising 14% to ₹4.44 lakh crore, and deposits growing 13%.

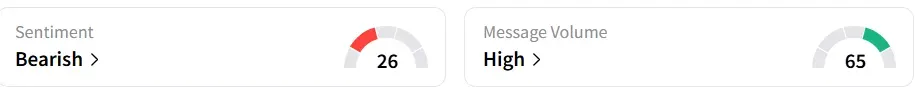

Retail sentiment remained ‘bearish’ on Stocktwits, amid ‘high’ message volumes. It was ‘neutral’ a month earlier.

Year-to-date, the stock has gained 10.4%

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)